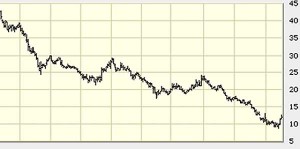

When do we hit bottom?

Tight credit, slow showroom traffic and a precipitous drop in fleet business reduced new vehicle sales in the U.S., during January, by 37 percent, to an annual rate of less than 10 million units – the lowest level since the early 1980s. It was the fourth month in a row where overall sales were off more than 30 percent.

The sales reports released Tuesday indicated that U.S carmakers suffered the most. Chrysler LLC’s sales dropped 55 percent, General Motors Corp. fell 48 percent and Ford Motor Co. dropped nearly 40 percent.

The Japanese Big Three, however, fared only modestly better as Toyota’s sales dropped 34 percent, Honda’s dropped 31 percent and Nissan’s fell 30 percent during January.

German luxury makers didn’t fare much better as Mercedes-Benz sales dropped 35 percent, Audi reported a 27 percent decline and BMW sales dropped 16 while Volkswagen of America’s sales fell 11.6 percent. Even Mini, which heretofore, was immune from the chilly economic environment reported a 15 percent decline in sales last month.

“We know 2009 has the potential to be another extremely tough year for the automotive industry due to continued challenges with the economy, yet we are optimistic for a successful future here in the U.S.” said Mark Barnes, Chief Operating Officer, Volkswagen of America, Inc.

“The overall market ran about 6 million vehicles behind where it was last January (on a seasonally-adjusted annual rate) and every manufacturer was deeply impacted,” observed Mark LaNeve, GM vice president of sales, service and marketing.

The South Korean carmakers, Kia and Hyundai, which reported a 14 percent sales increase, escaped the carnage, and Subaru actually managed a modest increase for the second month in a row.

“No auto company is immune from current market conditions,” said Dick Colliver, executive vice president of sales for American Honda. “The industry is in a bottoming phase,” suggested Toyota vice president Bob Carter, who didn’t see much hope for improvement before spring.

Chrysler vice chairman Jim Press said one key reason for the big decline in Chrysler’s sales was the company’s decision to forego sales to fleet customers, noting that Chrysler fleet sales last month declined by 80 percent to fewer than 2,000 units.

Ford and General Motors also reported huge drops in fleet sales. The decline was driven, in part, by all three companies’ decision to extend the plant shutdowns after the Christmas break, making it harder to fill fleet orders, executives said.

Automakers also report that sales have been clearly slowed by lack of credit. In addition, the decline in used car prices has left more buyers, including buyers willing to trade, “underwater,” making it more difficult to complete a deal.

Leases also are still hard to find. Steve Landry, Chrysler vice president of sales and marketing, estimated that leases accounted for only about 3 percent of Chrysler sales. In the past, leases had represented about 20 percent of the company’s sales volume.

Nevertheless, automakers took heart from the fact that it appeared the retail market had stabilized. The retail market is only about 8.3 million units annually right now but it shows signs that it is beginning to recover, noted Ford economist Emily Kolinski Morris.

“What we’re looking for is stabilization. You have to stop falling before you can start rising,” Kolinski Morris noted. “Consumers are responding to favorable prices and discounts,” she said.

Michael DiGiovanni, GM’s general director of market analysis, also noted that pent up demand is clearly building. The normal replacement rate for vehicles in the U.S. is about 12.5 million vehicles annually. With sales running below 10.5 million units, pent-up demand, at just the replacement level, is substantial now.

Press, however, cautioned that carmakers must be willing to operate in an environment in which new vehicle sales are no better than an annual rate of 10 million.

“The industry is in a bottoming process,” added Bob Carter, Press’ old colleague from Toyota. “It’s not going to look much better in February and March,” he said.