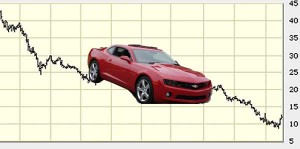

GM stock hits near-75-year low Friday.

With General Motors shares briefly plunging to their lowest level in three-quarters of a century, it should be no surprise that President Barack Obama marked the first meeting of his administration’s new auto task force by declaring there’s a need for a fundamental restructuring of the domestic car business.

A White House statement stressed that the administration understands the urgency of dealing with the problems facing Detroit’s Big Three. The task force, chaired by Treasury Secretary Timothy Geithner and National Economic Council Director Larry Summers, aims to get a clear handle on whether the domestic industry can be saved – particularly General Motors and Chrysler, which, on Tuesday, submitted “viability” plans to support the billions in loans former Pres. George Bush approved, last December, to keep them alive.

The new plans asked for an additional $21.6 billion in aid, while outlawing significant new cuts in production and employment aimed at keeping GM and Chrysler in business. The two makers will have to complete their proposals by March 31st, after which the task force will make its recommendation to Pres. Obama. He could agree to provide additional assistance, or take steps – such as calling in the existing loans – that would force the makers to declare bankruptcy.

The latter possibility is clearly weighing on investors, who briefly drove GM stock down to a near 75-year low of $1.53 a share in early afternoon trading. The last time the company saw that number was on July 26, 1934, in the depths of the Great Depression. By the end of Friday trading, GM shares recovered slightly, to close at an anemic $1.77, still down 23 cents or 11.5%.

Less than a year ago, GM CEO Rick Wagoner was frantically trying to stabilize shares then trading at around $8.00. The automaker’s stock actually has stood as high as $25.54, during the last 52 weeks, and was running above $50, at times, in the year prior.

But few expect to see those numbers again, at least anytime soon, and possibly never again. Analyst Joseph C. Amaturo, of the Buckingham Research Group, has cut his price target from $1 to zero, arguing that a bankruptcy filing was the best avenue for GM to begin its recovery. Other observers, however, fret that the crumbling maker might not be able to emerge from bankruptcy protection. Wagoner, meanwhile, warned this week that using the protection of the bankruptcy courts could cost billions more than the federal bailout it is requesting.

Though GM may be looking to head off a bankruptcy of its own, the automaker pushed its Swedish subsidiary, Saab, into the Scandinavian equivalent of Chapter 11, on Friday, after government officials refused the parent company’s request for financial assistance. Even if Saab somehow survives the latest setback, it appears likely that GM will either sell or close the long-struggling brand in the very near future.