Zetsche: It was either pry open an ATM or sell a stake to Abu Dhabi.

An investment fund controlled by the government of Abu Dhabi is now the biggest shareholder in Mercedes-Benz’s parent company, Daimler AG.

Aabar Investment PJSC is spending $2.72 billion for a 9.1 percent stake in the German company. Unlike many Mideast sovereign wealth funds, some shares in Aabar are publicly traded. But in a series of recent steps, the government has been steadily increasing its stake in the investment firm.

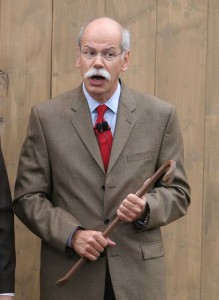

“We are delighted to welcome Aabar as a new major shareholder that is supportive of our corporate strategy,” Daimler Chief Executive Officer Dieter Zetsche said in the statement. “We look forward to working together to pursue joint strategic initiatives.”

“Daimler is an iconic brand and a financially strong company with a reputation for excellence worldwide,” said Aabar Chairman Khadem al-Qubaisi, in a statement. “We are delighted to have the opportunity to make this investment and are excited by the commercial potential of our partnership.”

The Daimler investment appears to be Aabar’s biggest foreign move to date. Last December, it bought the Swiss-based wealth management unit of the struggling American International Group, or AIG, for $273 million – a deal in which it also agreed to assume about $90 million in debt.

The move by the oil-rich sheikdom, one of seven semi-autonomous states comprising the United Arab Emirates, makes it the largest Mideast stakeholder in Daimler. The German automaker’s second-largest investor is the sovereign wealth fund of Kuwait, which holds a 6.9 percent stake.

Daimler’s decision to sell the 9.1 percent stake to Aabar marks a significant shift in direction for the German company. Only last June, the automaker announced a 6 billion Euro fund to be used to buy up its own shares, which were trading at a relatively modest 45 Euros, at the time.

The new investment comes at a challenging time for Daimler, which posted a 1.5 billion Euro ($2.04 billion) loss for the fourth quarter of 2008, compared with a 1.7 billion profit, the year before. The company’s flagship Mercedes brand has suffered a significant decline in sales, in recent months – especially in the critical U.S. market – a global demand for luxury products has continued to slump.

The loss also reflects the continuing impact of problems at Chrysler LLC. The German conglomerate sold off a majority stake in the American automaker in 2007, but retains a 19.9 percent stake.