GM auditor's "substantial doubts" could raise further opposition to federal bailout.

Are there simply too many cracks in the foundation for General Motors to survive? There’s clearly more reason to doubt the company’s viability, today, in the wake of a gloomy report from the company’s own auditors, which raises “substantial doubt” about GM’s ability to remain in business.

That is, of course, no surprise to GM’s many critics, including those who have actively worked to try to prevent the Obama Administration from approving $16.6 billion in additional assistance, on top of the $13.4 billion the automaker has already received in emergency loans.

The latest concerns, raised by the auditing firm, Deloitte & Touche LLP, certainly won’t help. The irony is that the questions are being raised in GM’s own annual report. Deloitte serves as GM’s auditors, and its analysis and guidance is a central part of the yearly statement, which is filed with the Securities and Exchange Commission and supplied to investors. To be fair, in the current global meltdown and credit crunch there are doubts about the viability of many automakers.

Last year, GM ran up $30.8 billion in losses, bringing to $82 billion the total red ink for the past three years. According to its auditors, the company’s losses, and its inability to raise more cash in the continuing – and potentially worsening – economic crisis translates into a “substantial doubt” about GM’s ability to remain a viable concern.

“There is no assurance that the global automobile market will recover or that it will not suffer a significant further downturn,” the company’s statement said.

Is the game over for Wagoner and GM?

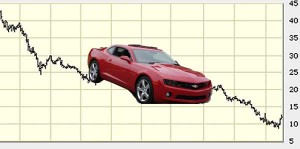

For GM, the auditors’ concerns complicates matters significantly. For one thing, it is certain to send GM’s stock – already at Depression-era lows – plunging. It could also raise “substantial doubt” among consumers, many of whom now worry about buying a car from a company that could soon be out of business. GM led all companies in sales declines last month.

But perhaps the biggest fear for GM management would be if the new report leads the Obama Administration to refuse to grant the additional billions in aid GM is requesting.

“If we fail to do so for any reason, we would not be able to continue as a going concern and could potentially be forced to seek relief through a filing under the U.S. Bankruptcy Code,” the company said.

GM – and its cross-town rival, Chrysler – must wrap up their presentation to the government by March 31st. A final decision on further government aid would follow soon afterwards.

GM, meanwhile, is also seeking a bailout from European governments, as TheDetroitBureau.com reported, earlier this week. The automaker has said that the collapse of those operations could result in the loss of 300,000 jobs, across the Continent. The Spanish government has agreed to provide $200 million in aid, but German Chancellor Angela Merkel reportedly told colleagues, earlier this week, that GM may not be important enough to the country’s economy to justify an aid package.

During an interview, this week, GM President Fritz Henderson said there is effectively “no Plan B” that could alternatively save the company’s European operations.