Is GM's economic pulse showing signs of revival?

In a stunning, surprise move, General Motors announced, last week, that it would not need a $2 billion infusion of cash from the federal government. Ever since then, my phone has been ringing off the hook, with friends, industry contacts and talk show hosts alike asking me what this news signifies.

In today’s 24/7 news cycle, the issue is proving to have plenty of “legs,” and when I was asked to comment on NPR, this evening, I thought it time to stop giving glib opinions and think more deeply about the meaning of impact of GM’s decision.

The most common question is why did GM decide to skip this tranche of aid? According to the automaker, it has made far more progress than it originally anticipated slashing its costs and rebuilding its under-funded war chest. Certainly, if the company has enough cash on hand to meet its obligations, it would seem logical to avoid borrowing still more money and running its huge debt load even higher.

But Is GM really that much ahead of where it expected to be right now?

Without having access to the secret documents the automaker is providing the White House automotive task force, there’s simply no way to know for sure. But there are some signs that it is making significant progress. Going into the new year, the company was due to reap increased savings from the contract it signed with the United Auto Workers Union, in 2007, an agreement that creates a two-tier wage system, transfers health care responsibilities to the union, improves general productivity and permits significant cuts in employment levels.

Now add the latest contract concessions the UAW has agreed to, along with the deals GM has been pulling together with all sorts of other stakeholders. The figures quickly and clearly are adding up.

At the same time, the automaker should still be feeling the impact of the huge recession, which delivered a whopping 53% decline in year-over-year sales, last month. Cash flow is definitely tight. There is, however, a factor that’s often missed by the general press. Automakers don’t sell directly to consumers. Their real customers are dealers. And after a big reduction in year-end production, dealer lots were actually looking a little empty, at least in some parts of the country, forcing nervous retailers to replenish at least a bit of their inventory.

Yet, no matter how I try to make the equation work, I must admit I am still having a hard time believing GM simply doesn’t need more bailout funds, even if that’s only for a month or so.

And that raises an interesting alternative theory.

The automaker’s announcement came mere days after its auditors, Deloitte & Touche raised a “substantial doubt” about GM’s long-term viability in the automaker’s annual report. By calling into question the company’s ability to survive – never mind thrive – the auditors lent unwelcome support to GM’s many critics, including Senator Cory Booker, the Tennessee Republican who is one of a group of bailout opponents dubbed, in Washington Circles, “The Senators from Toyota.”

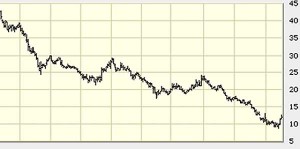

Remember, GM is asking to nearly double the handout it received in December, from the old Bush Administration. So, a temporary delay in getting $2 billion is comparatively small change. There’s a lot more money in play, and General Motors has to make a convincing case to the auto task force – and ultimately President Obama – by March 31st, when it hands in its final viability plan. Showing that there’s an upside to the current crisis, from a PR position, was a smart move, and came during a rare week when the stock market headed into positive territory.

Was GM simply playing the press? I’m suspecting that was at least a part of its strategy, and in some ways a welcome one. The automaker has made some surprising bubble-headed moves, starting with CEO Rick Wagoner’s decision to fly to Washington in a corporate jet in order to plead poverty before Congress.

Still, it’s hard to believe, considering the company’s desperate situation, only a few months ago, that it could have delayed taking the $2 billion without improving its corporate finances – at least a bit.

Whatever the back story, the decision seems to have helped the automaker’s case. But it still has an uphill battle if it hopes to win the additional bailout funds. There are a sizable number of critics, and the public’s patience with helping out fat cats is shrinking by the day — just witness the backlash to the bonuses giant insurer AIG is ready to pay its executives.

A final decision on the bailout is coming up fast. There’s no guarantee it will turn in GM’s favor. The automaker knows that one way or the other, it must improve its financial situation fast. So last week’s announcement can only be taken as good news.

A very good observation!

Based on this news and some other items like Citibank’s claim that it made a profit recently and didn’t think they needed more bailout money just right now, I’m starting to think something is up. And I don’t mean the economy. I’m starting to think that these corporate welfare queens are starting to balk at the strings attached being attached to their government (blank) checks. “They want me to give up my corporate jet?!? Cut my zillion dollar bonus just because the company is bankrupt?!? Act responsibly?!? Are you kidding me? Just so I can get another several tens of billions of taxpayer money to paper over my bad management? What the hell is the world coming to? No, sir. I don’t care if the company does tank and the world goes into the Great Depression II. I’ve got my principles.” This, I think, may be what’s really going on.