Despite numerous objections, Judge Arthur Gonzales gave the go-ahead for the sale of Chrysler, which means a deal to give Fiat control could be completed by late June.

Despite an urgent protest by its home state of Michigan, a federal bankruptcy judge, in New York, has given the initial go-ahead to plans to sell the vast majority of assets of Chrysler. It was a clear victory for the Obama Administration, which is betting on a swift reorganization of the company, and an indication that the judge agrees to the need for speed.

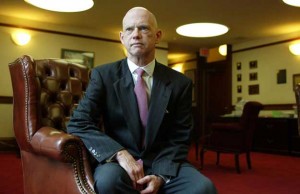

Wrapping up a full day of testimony and debate, Judge Arthur Gonzales approved a “clear and orderly” bidding process that is expected to result in the troubled automaker’s emerging from Chapter 11 under the control of Italy’s Fiat SpA.

Bids for Chrysler’s assets must be submitted by May 20, Judge Gonzales declared, with a final sale hearing scheduled for one week later. The final sale could take place in as little as 30 days afterward. Barring a subsequent legal setback, this would give both Chrysler and the U.S. Treasury Department precisely what they wanted – a quick and orderly march through the bankruptcy process that would be as minimally disruptive as possible.

That’s proving more critical by the day. With the automaker’s plants shuttered until it emerges from bankruptcy, and sales collapsing, numerous suppliers, ranging from steel makers to small parts manufacturers, are facing financial ruin of their own.

That’s proving more critical by the day. With the automaker’s plants shuttered until it emerges from bankruptcy, and sales collapsing, numerous suppliers, ranging from steel makers to small parts manufacturers, are facing financial ruin of their own.

A quick trip through U.S. bankruptcy court is also needed to satisfy Fiat, which has said it would walk away from a deal should the Chapter 11 process drag on too long. Judge Gonzales, meanwhile, approved a $35 million fee that would be paid to the Italian automaker should the deal with Chrysler fail to reach fruition.

Not everyone is happy with the court’s actions, however. While almost all key lenders reluctantly agreed to accept a settlement with Chrysler, late last month, others refused to accept the figures pushed by the Treasury Dept., the primary reason Chrysler had to go into bankruptcy. They will be pressing their case for a more lucrative deal in the weeks to come. But the judge got tough with them yesterday insisting the names of the hold-out companies be revealed, along with what they actually paid for the 10% of Chrysler debt that is in dispute.

There are other disgruntled parties emerging, including trial lawyers who appear likely to have the courts void any pressing product liability claims against Chrysler. A committee was formed, on Tuesday, to represent more than 100,000 unsecured creditors owed money by the automaker.

Meanwhile, the State of Michigan’s legal representatives put in an appearance before Judge Gonzales, on Tuesday. The automaker is a major contributor to a state fund designed to protect workers injured on the job, noted Michigan Attorney-General Mike Cox, in a legal brief, with annual payments of $25 million and a total, current obligation of $140 million to $150 million. A decision by Chrysler to walk away from that debt could bankrupt the system, the Michigan Workers’ Compensation Agency and Funds Administration, state officials warned.

The judge, however, put off a decision on that objection, arguing that for now, the key goal was speed. There is “an urgent need for the sale to be consummated,” said Gonzalez.

The inherent value of Chrysler is declining by “hundreds of millions of dollars” every day, echoed the automaker’s lead bankruptcy attorney, Corinne Bell, adding that, “Chrysler is a wasting asset.”