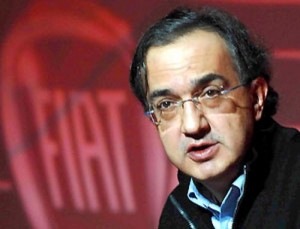

Fiat CEO Sergio Marchionne boycotts meeting with senior German leaders over the sale of Opel.

The increasingly complicated effort to save General Motors’ German-based Opel subsidiary ran into yet another snag, today, when Fiat, one of the two remaining bidders hoping to acquire a controlling chunk of Opel, decided to boycott a bailout meeting, in Berlin.

The Italian maker’s move comes barely a day after German government officials ignored their own deadline and refused to complete work on a $2 billion bridge loan package Opel says it needs if it hopes to continue operating long enough to complete a sale.

The Friday meeting was supposed to bring together representatives from the two bidders, Fiat and Canadian mega-supplier Magna International, as well as GM executives and officials from both the German and U.S. governments.

But a spokesman for German Chancellor Angela Merkel now says such a high-level meeting will only take place if, “those involved … have something substantial to produce, contracts that carry their signatures.” Without Fiat’s involvement, that appears unlikely.

But a spokesman for German Chancellor Angela Merkel now says such a high-level meeting will only take place if, “those involved … have something substantial to produce, contracts that carry their signatures.” Without Fiat’s involvement, that appears unlikely.

Fiat CEO Sergio Marchionne, who hopes to stitch together a global powerhouse including both Opel and bankrupt American automaker Chrysler, said he is not dropping out of the Opel discussions, but he added that his decision to skip the meeting was a protest of “unreasonable” financial demands.

As he did with Chrysler, Marchionne has been proposing an Opel acquisition that would require Fiat to put up little, if any cash. Fiat reported a Q1 loss of €410 million ($536 million) in 2009, compared to a profit of €405 million a year earlier.

“The emergency nature of the situation cannot put Fiat in a position to take on extravagant risks,” Marchionne told reporters Friday. “We have already offered to contribute our auto business assets to the merger on a debt-free basis and thus provide substantial … equity to the merger.”

The Opel situation has taken a number of twists and turns, this week. A government deadline brought three potential bidders, fewer than some observers had expected. Then the U.S. equity fund, Cripplewood, dropped out. And, at an all-night meeting with German officials, Opel revealed it would need to get another $420 million in bridge loans to keep its operations – which employ 25,000 Germans – going.

Without government aid, a senior executive told TheDetroitBureau.com, Opel would face the threat of a near-term insolvency. And that, he added, would force it to do a “fire sale” of its assets, rather than conduct a reasonable round of negotiations with whomever was picked as the preferred bidder.

“What happened,” during the late-night negotiation session “borders on the absurd,” proclaimed German Economics Minister Karl-Theodor zu Guttenberg, after the session broke up, Thursday morning. “I would hope for more seriousness and willingness to compromise from the U.S. side,” he added, in a meeting with reporters.

As the situation grows more dire, observers are wondering whether the German government might have to do more than just provide short-term loans to keep Opel afloat – much as is happening in the U.S., where the Obama Administration expects to secure a roughly 70% stake in a “new” General Motors.

“We are doing everything to find a different solution,” Chancellor Merkel told the German weekly Der Spiegel. “But a direct state holding in Opel does not come into question for me.”