Defying gravity, Subaru is gaining share in a down market and could actually get sales in the black with the launch of its all-new, 2010 Legacy sedan.

“Flat is the new up,” declared a Subaru of America official, earlier this year. And while the automaker has since discovered it can’t entirely escape the laws of gravity in a viciously weak market, Subaru is one of the only car brands that has actually been able to make the recession work in its favor.

Until the economy went into a complete nose-drive, last autumn, the small Japanese automaker was actually heading for an all-time sales record, notes SoA senior vice president of sales, Tim Colbeck. And while that goal is off the table in the current climate, the launch of new products, like last year’s updated Forester and the all-new, 2010 Legacy sedan, are helping it avoid the fate of even the strongest industry powerhouses, like Toyota.

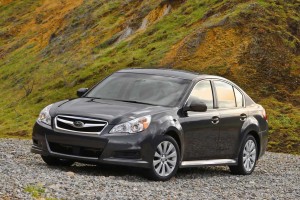

“We’re in a race with ourselves,” says Colbeck, who has been in Seattle, this week, for the first media drive of the new Legacy, which is now celebrating its 20th year on the market. “Our objective, with this car, is to get Subaru sedans on the map,” he continues, adding that for the maker to grow, it has to tap into not only new product segments but also expand its position beyond its long-standing core markets.

Subaru’s success has confounded some critics who, not many years ago, thought it among the most vulnerable of import brands. It was, for many years, little more than an asterisk on the sales charts. Then the maker came up with the idea of bulking up its wagon models, rechristening them “Outback, and hiring Paul Hogan, the then-popular actor behind the “Crocodile Dundee” movie franchise.

Subaru’s success has confounded some critics who, not many years ago, thought it among the most vulnerable of import brands. It was, for many years, little more than an asterisk on the sales charts. Then the maker came up with the idea of bulking up its wagon models, rechristening them “Outback, and hiring Paul Hogan, the then-popular actor behind the “Crocodile Dundee” movie franchise.

It didn’t hurt that, as American motorists began switching from cars to light trucks, there was growing interest in all-wheel-drive, a signature feature on all SoA products. Meanwhile, the company made a decision not to try to aim for the mainstream automotive market, Colbeck explains. Instead, it has carved out a successful niche by targeting small, but affluent groups like nurses, outdoorsmen and gays – “people who have the feeling they’re our kind of buyer.”

These audiences have proved to have unexpected staying power, despite the current economic crisis, notes the Subaru executive. The automaker has experienced only a minimal dip in the number of potential buyers who are qualifying for loans, for example. Meanwhile, it’s been able to maintain its own access to the funds needed to keep leasing its products. Some makers, like General Motors and Chrysler, have had to give up leasing entirely, with a direct, and sometimes harsh, impact on sales.

All in all, SoA saw its sales dip just 1.8% during the first five months of 2009, and there could be some positive news in the months to come. A preliminary report from J.D. Power and Associates shows that sales during the first half of June showed signs of recovery, and that matches Subaru’s own reports, Colbeck suggests. If so, the brand’s sales could be back in positive territory, putting it on track to match the 187,699 vehicles it sold in 2008 – though still short of its 2006 record of 200,703.

But that gets back to the comment made back in February, at the Chicago Auto Show, when Subaru first unveiled the new Legacy. When the market is in freefall, flat is indeed up – level sales translating into a big bump in market share. From a low point of just over 1% share, earlier in the decade, Subaru has been running at 1.9%, so far this year, and Colbeck believes it could punch into 2% territory, if the new Legacy connects with buyers. Significantly, sales of the outgoing model hit an all-time record, last month.

That’s good news for a brand that has never been able to make a real market with sedans. Though it’s clear Subaru isn’t about to walk away from the niche product strategy that has worked so well in recent years. AWD vehicles, like the Legacy Outback, have proved especially popular in wet and snowy climes, such as New England, the Northwest – where Subaru is one of the market’s largest nameplates – and Colorado.

Then there’s the WRX and STi models, which have helped Subaru punch its way into the tuner and performance segments in tough markets, such as Los Angeles. Colbeck confides that the maker is working up a new marketing campaign it hopes will help build demand for those two models among the large Hispanic community in Southern Florida, where until now, Subaru has barely registered with buyers.

The Subaru line-up is expected to expand, over the next couple years, in part due to the assistance of the small maker’s big partner. Toyota Motor Co. bought a stake in parent Fuji Heavy Industries, several years ago, when those shares were spun off by General Motors. (The U.S. giant briefly hoped to use the alliance to access Subaru’s all-wheel-drive and boxer engine technology, but failed to find the required synergies.)

A hybrid appears to be on tap, probably utilizing a variation of the Synergy Hybrid Drive system popularized by the Toyota Prius. Also on tap is a new sports car, Subaru’s first in several decades. While Colbeck won’t discuss details, it is reportedly set for launch around 2012.

In a topsy-turvy market, there are few guarantees. Just ask Subaru’s partner, Toyota. For decades, it seemed unable to do anything wrong. Yet, in recent months, its sales have declined by as much as 40%. Subaru is well aware that there’s no guarantee it can maintain its own momentum. But, then again, there are no signs that it’s slacking off. And if it can expand the appeal of the Legacy line, while also building in weaker markets like Miami, the automaker just might be able to say that up really is a lot better than flat.