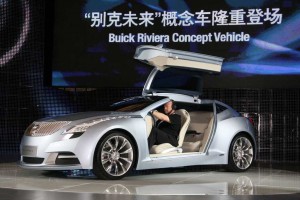

Buick unveils its Riviera concept vehicle in Shanghai. The booming Chinese market is helping GM and Ford offset declining sales in the U.S.

Forget the Red Menace. When Detroit automakers think of China, these days, they’re thinking green.

While the U.S. automotive market may be defying all forecasts for a recovery, the Asian nation has confounded analysts who expected demand in cities like Shanghai and Beijing to begin tapering off. While there has been some modest dip in Chinese car sales, the government’s aggressive actions on the economy have proved surprisingly effective at propping up the market.

And that’s good news for American makers, who desperately need to counter their home market declines.

Ford, a relative latecomer to the booming Chinese market, saw sales soar 14% during the first half of 2009, and June sales, in particular, climb a staggering 55% compared to year-earlier numbers,

General Motors, which has been locked in a long battle with Volkswagen for supremacy in the China market, posted even bigger gains for the first half. GM’s January-to-June volume rose 38%, boosted by growing demand for the Wuling mico-minivans it produces as part of one of its many Chinese joint ventures.

Joint ventures are a way of life in China, where the government generally requires that all foreign manufacturers have a domestic partner. GM’s Buick operations, for example, are shared with the Chinese giant, SAIC. Ford, meanwhile, partners with both Japan’s Mazda and China’s Changan to produce passenger cars. And it operates a commercial vehicle joint venture with Jiangling.

The Beijing government has been extremely aggressive, hoping to keep the global economic slump from spreading to its shores. That includes significant automotive sales incentives – such as sales tax cuts and subsidies to replace older, less fuel-efficient vehicles – which helped boost the overall Chinese passenger car market by 21% during the first five months of 2009, and 46.8% during May alone. (Industry-wide figures for January through June aren’t yet available.)

The Chinese market is expected to top 11 million units, this year, according to the trade group, the China Passenger Car Association. By comparison, the U.S. market is struggling to reach the 10 million mark, with analysts such as J.D. Power and Associates repeatedly downgrading their forecasts and delaying expectations of a recovery.

China’s market surpassed America’s in January, for the first time – and a good decade ahead of most analysts’ expectations – and has remained bigger every month since.