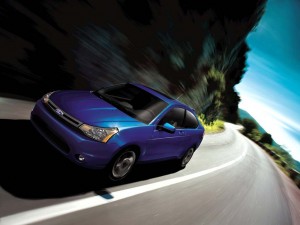

Ford fared best, among the Detroit makers, from the Cash-for-Clunkers program, its Focus being the top seller - and driving the company to post its first monthly gain since late 2007.

Car sales showed some new life in July, thanks to the boost from the federally-funded Cash-for-Clunkers program. But it wasn’t a lot of life — and several manufacturers, among them General Motors, Toyota, Mercedes-Benz and BMW, posted fairly solid drops.

The Clunkers program was blamed, by many, for a slowdown in sales during the final weeks of June, with potential buyers waiting to make sure if Congress would authorize givebacks of up to $4,500. Once enacted, many dealers, and at least one automaker, Hyundai, quickly took steps to get buyers into showrooms as soon as possible, even if they couldn’t immediately give those shoppers their federal payouts.

On the whole, Detroit makers fared more poorly from the program – with the exception of Ford Motor Co., the only domestic maker to skip a federal bailout. Ford posted a quite respectable 2% increase in sales, and the Ford Focus was said to be the number-one seller under the Clunkers program, more formally known as the Cash Allowance Rebate System.

But the other big winners were the South Koreans. Hyundai posted a 22% sales increase, while its sibling brand, Kia, reported a 9% sales increase. Hyundai had been well prepared for the Cash-for-Clunkers program, from a marketing standpoint, and had encouraged dealers to accept trade-ins nearly two weeks before the U.S. Department of Transportation officially launched the program by fronting the money.

Subaru, meanwhile, posted a 34% sales increase. The small Japanese maker has defied the automotive downturn and is the only maker to be running virtually flat for 2009 despite the overall industry decline, so far this year, of about 35%.

The Japanese giants didn’t do nearly as well, however. Toyota reported that its sales tumbled 11.4%, while Nissan’s fell nearly 25% and Honda’s were off 17.3%, as overall industry volumes failed to move much beyond the 10 million unit level that has been the effective cap throughout the 2010 model year.

Vokswagen AG managed to post essentially flat sales, while BMW posted a 26.7% sales drop and Mercedes-Benz was off 25%. Audi sales also dropped 6%.

Chrysler beat some downbeat forecasts, reporting a comparatively modest 9% sales decline. The automaker succeeded in cutting inventories, bloated by its decision to eliminate 789 dealers as part of its move through the bankruptcy courts. Chrysler also has dramatically reduced fleet sales, its traditionally back door outlet for excess inventories.

Consumer traffic in Chrysler, Jeep and Dodge dealerships more than doubled during the last week in July, compared with the same time period in 2008, the company reported. The increased consumer traffic was driven by interest in the CARS program. The automaker, now under the control of Italy’s Fiat, launched an aggressive incentive program, during July, in which it offered to match the Clunkers voucher, meaning up to $9,000 in savings for qualified buyers.

“The government’s program is doing what it is designed to do — spur consumers to trade in older gas guzzlers for new, fuel-efficient vehicles,” said Peter Fong, president of the Chrysler Brand and Lead Executive for the Chrysler Group.

“While we don’t expect the industry sales forecast to change dramatically, we are seeing encouraging signs that consumer confidence is building, and more consumers are considering purchasing a new vehicle,” Fong added.

Despite an 18% decline in sales, Mark LaNeve, GM’s vice president of sales, said the long-troubled automaker’s own numbers revealed signs of improvement. “We anticipate an additional sales lift in August if Congress approves more funding for the wildly-popular Cash-For-Clunkers economic recovery program.” LaNeve suggested.

We had another strong month in progress before the ‘Cash-for-Clunkers’ program started,” said Ken Czubay, Ford vice president, U.S. Marketing, Sales and Service.

“Our products, our dealers and our advance preparation enabled us to leverage the program and drive traffic and sales to another level,” he added. “In addition, we achieved a sales increase even though we decreased incentive spending in an increasingly competitive environment,” Czubay said.

Jim Lentz, Toyota Motor Sales president, said the CARS program generated significant incremental sales this month.

“Beyond the tangible economic stimulus, the positive environmental benefits of the CARS program is clear to see,” said the TMS President. “The program is achieving its goal of increasing fuel efficiency. CARS-related Toyota sales, over the seven days alone, will save customers an estimated 8 million gallons of gas and 20 million dollars in gas spending over the next year,” Lentz concluded.