Taxpayers are not going to recover anywhere near the money they have invested in automakers and their subsidiaries, according to a report just released by the Congressional Oversight Panel.

The Panel, which is investigating the U.S. Treasury Department’s Troubled Asset Relief Program (TARP), criticizes Treasury’s ongoing lack of transparency about the wildly unpopular auto bailouts.

The latest report follows the money and looks at how tens of billions of taxpayer dollars have been used to support Chrysler, General Motors, GMAC and parts makers.

In protecting the interests of taxpayers, the Panel found that Treasury “negotiated aggressively with all the players,” and now holds a combination of debt and equity in the reorganized Chrysler Group, General Motors Company and GMAC.

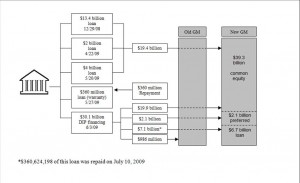

- U.S. taxpayers have lent $49.9 billion of TARP funds in conjunction with GM’s bankruptcy and the subsequent creation of General Motors Company.

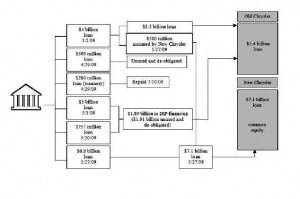

- The Chrysler transactions have spent $14.3 billion of TARP funding, of which $10.5 billion remains outstanding.

- Assistance to automotive suppliers and investments in GMAC, the financial institution dedicated to automotive lending, account for another $16.9 billion of TARP resources.

- Total TARP net support for the U.S. domestic automotive industry is slightly over $81 billion as of September 9, 2009.

A problem comes when trying to figure out how much of this will be paid back. Earlier Congressional Budget Office estimates said that between 65% and 75% of the money was lost. The estimates, alas, still appear reasonable.

In the latest investigation, Treasury officials told the Panel staff that recovery of TARP investments in the automotive industry would be dependent upon the value of the stock that Treasury holds (or subsequently receives) in the two companies when they are able to go public. Therefore, the prospects for recovery of the TARP investments depend on the forecast for Chrysler and GM stock appreciation, which is something that cannot be predicted.

However, in discussions with the Panel Treasury agreed with the Panel’s assessment that the new companies’ stock prices will have to appreciate sharply for taxpayers to be fully repaid.

Chrysler Group

In the Chrysler bailout, Treasury has invested a combined $14.3 billion in the new and old entities, including $1.5 billion for Chrysler Financial and $280 million for the Chrysler warranty program.

The bankrupt Old Chrysler is liable for $3.5 billion of TARP financing, and given the competing claims on that estate, payment is “unlikely.”

Taxpayers’ interest in the reorganized Chrysler Group includes a note for $6.6 billion that includes up to $533 million of payment-in-kind interest and an issuance fee of $288 million, and a $500 million loan assumed from Old Chrysler and an equity ownership share.

The Panel did not have access to equity valuations for New Chrysler since it is and was privately held. The panel said that it is clear that – with $12.5 billion invested ($14.3 billion less Chrysler Financial and the Chrysler warranty program, which have been repaid) and assuming repayment of both the $7.1 billion of this investment in the form of notes as well as the fees and payment-in-kind interest of $821 million – the Chrysler equity interest would need to achieve an investment value of approximately $4.6 billion.

This implies a total capitalization of Chrysler Group of $57.5 billion in order for taxpayers to recoup their investment.

Chrysler provided the following statement to TheDetroitBureau.com: “Chrysler Group Chrysler Group LLC, our employees, unions, dealers and suppliers are extremely grateful for the opportunity we had to form a new company built on a global strategic alliance with Fiat. The company is still in its infancy and is in the process of finalizing its long-term product plans. However, with a significantly reduced cost structure and improved access to fuel efficient technology and international distribution channels, Chrysler Group will be in a stronger position moving forward.

“There is an agreed upon plan for repaying our debt to the U.S. Treasury. Based on the significant interest rates on the outstanding debt and the government’s equity stake in the company, we are confident that taxpayers will be more than paid back for their investment.”

General Motors Company

Looking at the General Motors Company, the panel said that the sizable amount of debt for which the company is responsible means that repayment of the TARP financing will require New GM stock after it is issued to appreciate to a level that is “highly optimistic.”

The value of General Motors Company used by the bankruptcy court estimated that the market capitalization (the price of all outstanding shares) of the new entity would be worth between $59 and $77 billion in 2012. Treasury has invested a combined $49.5 billion in the New and Old GM and holds on paper approximately 61% of equity in General Motors Company.

Assuming full repayment of the $8.8 billion note and preferred stock issued by the new GM Company to Treasury, the shares in General Motors Company will have to be worth $40.7 billion (the difference between $49.5 billion and $8.8 billion) for Treasury’s investment to be repaid when Treasury sells its shares

This means the market capitalization of the entire company needs to be worth $67.7 billion. In April 2008, when Old GM shares were at the height of their value (not adjusted for inflation), the company’s total value was only $57.2 billion.

Therefore, General Motors Company will have to achieve a market capitalization that is higher than was ever achieved by Old GM– if taxpayers are to break even.

In a written statement to the TheDetroitBureau.com GM said:

“GM respects the TARP Oversight Panel’s role and their important work. As a new company, GM’s full energy and resources are now directed to customers, cars and a culture to succeed. We are confident that we will repay our nation’s support because we are a company with less debt, a stronger balance sheet, a winning product portfolio and the right size to match today’s market realities.

“Going forward, GM and its Board of Directors are committed to setting a standard of excellence for corporate governance and we expect to be held fully accountable to deliver results. GM will be transparent in its business and regularly report its results, issue 8Ks, and provide information to the government and the public to measure our progress,” the statement concluded.

Oversight Panel Observations

The Panel requested access to numerous internal documents from Treasury in order to determine the extent to which the Treasury auto team conducted “due diligence.”

It then made the following observations:

- “On the basis of the information that Treasury has provided to the Panel, it appears that the auto team conducted due diligence as a private investor would and were fully informed when making its investment decisions.

- “The auto team seems to have had a reasonable basis to believe in the long term viability of the two companies.

- “This does not necessarily mean that the investment decision will prove to be a profitable one; the automotive sector in the United States is risky and these companies have a legacy of failure.

- “Additionally, while Treasury followed the process that a private investor would follow, that does not mean its objectives were those of a private investor. A private investor seeks to establish it is receiving a reasonable rate of return on its investment through the due diligence process.”

The panel also said “there are significant obstacles to the two companies’ ever achieving the level of profitability that would permit the return of all the taxpayer funds expended, and Treasury’s best estimates are that some significant portion of those funds will never be recovered.

Such is the price of our lack of an industrial policy. Successive Congresses have ignored the importance of the automobile business to our economy and the good middle class jobs it creates. The Report is notably silent in this area as unemployment climbs to record highs in the post war period. Treasury is not the problem here. It took decisive action to save what little of our automotive industry was left after decades of policy failures on the part of our executive and legislative branches.