The Korean automaker Hyundai clearly benefitted from U.S. taxpayer cash in August as its sales increased 47% from the year before.

Perhaps more significant is the movement of the Elantra model into the Top Ten U.S. seller list for the first time by jumping up seven places. The compact, fuel efficient car is no stripper either. Asking prices range from $15,000 to $20,000, and 21,000 of them were delivered during the month, twice the number of the comparable period in 2008.

Though its engine still uses a cast iron block and Elantra isn‘t the most sophisticated or quiet small car, the Korean import has an EPA rating of 25 city and 33 highway and has been supported by clever marketing campaigns all year long. Eight of the ten vehicles that saw the most Clunker sales were from offshore brands.

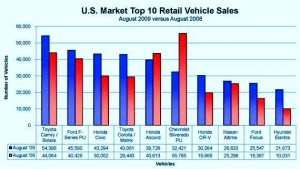

The other vehicles on the Top Ten list are the usual best sellers, although the list shuffled a bit to reflect the strong preference for cars by the many shoppers who were converted into buyers. It didn’t help that two of the strong players in the truck business, General Motors and Chrysler, were newly emerged from bankruptcy and with their plants either shut down or just coming back up as the sales frenzy began.

The first question is will the frenzy continue?

“To me, the jury is still out on ‘Cash for Clunkers.’ Only after September and October will we know the overall, net impact of the program. Historically, these major spikes in consumer demand created by one-time incentive programs have been followed by similarly major troughs, resulting in marginal long-term benefits. We’ll see,” said Tom Libby, Society of Automotive Analysts president.

In the here and now the Top Ten points to the ongoing weakness or absence of domestic carmakers in the fuel efficient sub-compact, compact and mid-size segments. Yes Ford has its old-gen Focus, and GM has some nice small cars of its own, but neither company seems able to convert consideration – if they even get that – to actual purchase from the growing number of largely happy import brand owners.

Also notable is the absence of any Chrysler Group vehicle on the Top Ten list, even though the company offered to double the $3,500 to $4,500 taxpayer rebate on select models. That’s right $9,000 cash on the hood largely left intact.

In the “ichiban” spot, Toyota Camry bumped Ford’s F-Series pickup truck where it has been comfortably residing since last April. Not much significance in this from where we sit, since CARS really favored, well, cars more than trucks. The F-Series did however post a sales increase, up 13% to 45,590, partly because of increased showroom traffic, and partly because of Recovery Act spending on roads and construction, which helps truck sales in the view of Ford analysts. It was the first sales increase for F-Series since October 2006 and has been a long time coming.

The gap between F-Series at number two and Chevrolet Silverado at number six, separated by entries from the Big Two powerhouses Toyota and Honda is less significant than it might seem at first glance. If you add in the current sales of 11,000 or 12,000 GMC Sierra trucks to the Chevy tally, then you have a horse and a horsepower race; to say nothing what it might look like if GMC makes a comeback from its current depressed levels.

And what of the Dodge Ram? Well during the bankruptcy it slid off the Top Ten list and hasn’t made a return. Considering that Fiat-controlled Chrysler Group has five new owners who are trying to figure out how to run the place, it might be awhile before marketing gets rolling again in Auburn Hills, or is that Italy?

It’s not just Chrysler with the long term sales problem. At the end the month, as you can see, seven of the ten top selling vehicles were from offshore brands. In July it was six. As a rough calculation does this mean the offshore brands are headed for 70% of the U.S. market? Domestic are holding 41% share right now, roughly tracking their four Top Ten for 40% of the market.

Well, one month does not a trend make.

However, decades do.

Chrysler, GM and Ford need to prove that they can regain some – any? – of the market share they have been steadily losing. If not, more cuts or that last ride to the big sleep is on the way.

See you next month for another round of Top Ten sorting and second guessing…

Ken,

I mentioned unfair South Korean trade practices to Paul after his reveal on the new Hyundai Sonata. My impression is that the Koreans slap a pretty hefty tariff on our cars, therefore amking them uncompetive. Meanwhile, they are free to sell their cars here sans any tariffs, and because of their gov’t subsidies (OK I realize that landscape is changing)and way-lower labor rates, they can sell their cars at price points others just can’t achieve. Am I way off? If I am still on base with my assessment, I maintain this is sooo wrong, and I don’t understand why the UAW doesn’t come out more strongly against the issue…

Under Korean industrial policy, the Korean auto market is in effect restricted to U.S. based makers.

Korea imposes an 8% tariff on U.S. made vehicles and parts, compared to 2.5% on vehicles sent from Korea into the U.S.

Korea also penalizes U.S. vehicles with high taxes on larger engines, U.S. makers complain, but that’s a product choice.

Other critics of Korea point out that the country is now accustomed to shipping more than 800,000 cars annually into the U.S. while fewer than 8,000 cars from the U.S. are sold there. Well, yes, those are the numbers.

In addition, Korea protects its agri-business with subsidies that are among the largest in the world while restricting U.S. farm imports. And, of course, there are non-tariff barriers, as well charges of government agency corruption.

As a result, a proposed “free trade agreement” with Korea worked out in 2007 is currently stalled in the U.S. Congress, as members are apparently rethinking a U.S. trade policy that has wiped out whole sectors of the economy by allowing unrestricted access to the U.S. market.

The U.S. remains the only industrialized nation the world without a formal government agency to oversee trade policy and protect jobs. It is politically impossible, in my view, for a Democratic Administration to go ahead with a “free trade” agreement with the U.S. economy at depression levels.

Hi Ken,

Thanks so much for the outline of the situation. I suppose if the playing field was level with SK I might not be so tweaked about it all. Maybe that’s what the free trade talks are supposed to do? Meanwhile, I suspected it was bad, but when you start layering in the other elements (agribiz for one) my opinion of the situation sinks even lower. I’m not sure why this issue doesn’t receive more political attention, especially when Hyundai trumpets its success in this market. And why are the Unions so silent? My slow burn just got a little hotter!

Best, Steve