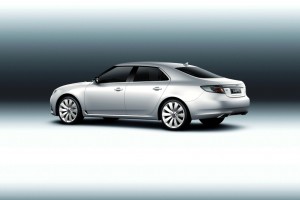

The fate of an all-new version of the Saab 9-5 sedan will depend on whether Spyker can raise the money to purchase the brand from GM.

The troubled Swedish automaker, Saab, has been given an 11th-hour reprieve, though it’s far from certain the brand has been saved.

Numerous reports out of Europe – supported by American sources – indicate that General Motors has agreed to extend its self-imposed December 30th deadline for shuttering Saab, one of four brands it said it would either sell or close after emerging from bankruptcy protection last July.

The initial funding plan for Spyker’s acquisition of Saab has fallen through, but the Netherlands-based company is reportedly seeking another line of financing; and GM is giving the carmaker time to pull that together.

“The December deadline has been lifted and the final offer from Victor Muller [chief executive of Spyker] must be made by 7 January now,” a spokesman for GM of Europe told the British newspaper, The Guardian, which added that raising the necessary cash appears to be Spyker’s only obstacle, at this point.

Even with the original deadline, Saab wasn’t going to vanish overnight. GM’s U.S. spokesman Tom Wilkinson stressed that there would be a “winding down” of operations, and at the very least, some Saab production would continue into early 2010. That would provide product for the brand’s dealers if they were to begin a staged shutdown of their own operations.

What’s unclear is whether GM would move ahead on production of the next-generation 9-5 sedan, a critical offering that was supposed to help Saab finally and fully differentiate itself from the rest of the General Motors line-up.

Industry analysts have long faulted GM for “badge-engineering” Saab products, such as the 9-7 sport-utility vehicle, which was virtually identical to SUVs sold by other General Motors brands. It made it difficult to support marketing campaigns for the Swedish maker, such as one that said its products were “Born from Jets,” a reference to Saab’s aerospace heritage.

Going forward, the Swedish brand will require significant investment and a largely all-new line-up.

“I think GM wants to be seen as doing everything it can to save Saab, but in a market like this one, Saab wouldn’t be a great loss,” says Stephanie Brinley, auto analyst with AutoPacific, adding, “I’m not sure it can be saved.”

But Spyker’s Muller seems intent on finding a way. He originally turned to the European Investment Bank for financing. Since that bid was rejected, Muller has turned to some of the backers of his own, miniscule manufacturing operation. The dominant investor in Spyker is the Russian bank, Convers Group. It is, in turn, controlled by the Russian entrepreneur, Alexander Antonov, whose son, Vladimir, serves as Spyker’s chairman.

As small as Saab is – it turned out 93,000 vehicles in 2008 and will sell even fewer when the books are closed on 2009 – it’s a veritable giant compared to Spyker, which sold just 43 of its high-performance sports cars, which carry prices in excess of $250,000, last year.

Saab’s losses of $340 million last year, also overwhelm Spyker’s balance sheet. The Swedish maker has been running in the red for eight years and hasn’t come close to financial solvency since GM first bought a 50% stake in Saab Automobile in 1989. (The U.S. maker later acquired Saab outright and has spent billions on it to no avail.)

So, how serious is Spyker’s bid? Even though the GM Board of Directors is willing to give Muller more time, a senior source said this should be viewed “in perspective,” adding that, “The Swedes are jumping on every rumor as if it is white smoke from the Vatican.”

While Saab may not survive, there will likely be something remaining of the Swedish auto industry. GM subsidiary’s national rival, Volvo, also is about to undergo serious change. About a decade after purchasing Volvo for $6.45 billion, the company’s U.S. owner, Ford Motor, is finalizing its sale to fast-growing Chinese automaker Geely for just a rumored $2 billion. How much of Volvo’s operations will remain in Europe is unclear.

GM Statement Regarding Stephen Taylor and Peter Torngren Appointments at Saab 2010-01-12

GM today confirmed that Stephen Taylor and Peter Torngren have been officially appointed by the appropriate authority in Sweden as wind-down supervisors of Saab and in this role they will jointly replace the CEO and board immediately. They will meet with management, unions and other stakeholders, and will start working on a plan for an orderly wind down.

As stated previously, the wind-down process is expected to take several months, and will ensure that employees, dealers and suppliers are adequately protected. Also as stated previously, Saab customers can be assured that warranties will continue to be honored and that service and spare parts will continue to be available.

GM today also reaffirmed that it is continuing to evaluate the several purchase proposals it has received for Saab, an evaluation not affected by today’s official appointment.