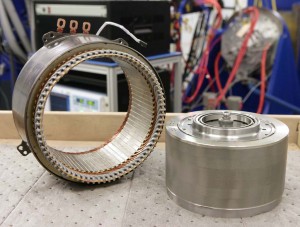

Simple, perhaps, but an electric motor, like this disassembled one, could be critical to winning in tomorrow's battery car market.

With battery technology likely to play an increasing role in the auto industry, General Motors will invest $246 million to set up a plant producing the motors needed to run tomorrow’s electric vehicles, the company plans to announce at this week’s Washington Auto Show.

GM would be the first domestic automaker to produce its own hybrid electric motors, and one of relatively few worldwide.

Final details, such as the location of the plant, won’t be announced until later this week, but GM officials say that motors must become a “core competency” for the company, much like internal combustion engines are today. Until now, GM has relied on outside suppliers, such as Hitachi, to provide motors for its hybrid-electric vehicles. But as the company sets out plans to increase the number of battery-based vehicles in its portfolio, it has decided that with something so critical as motors, “It’s best to do it yourself,” said Tom Stephens, the automaker’s global product development director.

There are, in fact, three key components to a battery-based vehicle that GM now sees as core competencies – in other words, technologies it feels it must understand, develop and manufacture on its own: batteries, electric motors and the power electronics required to make an electric vehicle run.

Earlier this month, GM began production at a new plant, in the Detroit suburbs, that will produce the batteries used in the 2011 Chevrolet Volt extended-range electric vehicle, or E-REV. The facility is part of a partnership with South Korea’s LG Chem, which is supplying the basic chemistry for the Volt’s lithium-ion batteries.

Stephens said GM’s goal is to come up with a wide range of products, from so-called “mild” hybrids, up to pure battery-electric vehicles and even hydrogen cars. That reflects the general industry consensus that there is no so-called “silver bullet,” a single alternative that can take over for the time-tested gasoline engine.

“We have to come up with a robust product portfolio,” explained Stephens, “that can take advantage of all these energy alternatives, and do it efficiently.”

Today’s electric motors are generally far more efficient at using energy than the internal combustion engine, said Pete Savagian, GM’s director of hybrid and electric architectures. That’s particularly true with automotive motors, which he said now can produce twice the power output per kilowatt of motors used in industrial applications. Even so, Savagian stressed there are significant improvements to come. And GM would rather control the development chain from top to bottom.

Increasing the efficiency of the motors used in tomorrow’s cars is only part of the challenge. Cutting cost is another issue that GM hopes to address. The most efficient designs use expensive rare earth metals that can cost as much as $200 for the magnets in a single motor for a hybrid vehicle. Quality and reliability are other challenges.

Stephens said GM won’t abandon outside motor suppliers entirely. Like the rest of the electric vehicle field, motors are evolving too rapidly, and cutting ties to outside developers could leave GM in an uncompetitive situation if it can’t stay on top of the technology.

The new plant should create “over 100 jobs,” according to Stephens. It’s expected to go into operation around 2013, and it will be used to provide motors for the next generation of GM’s two-mode hybrid powertrain. Currently, the system is in use on some of the automaker’s biggest vehicles, such as the Cadillac Escalade Hybrid.

The improved two-mode system will be downsized and cheaper to build, confirmed Stephens, which “will allow us to use (it) in more than just full-size trucks. We’ll be able to package it into smaller cars.”