At a news conference in Detroit late this morning, GM chairman and acting CEO Ed Whitacre, Jr., said that he has agreed to take the CEO job for an indefinite period following a request by last week by the U.S. government-packed board of directors.

The announcement confirms new reports, including ours, of earlier today, and possibly calls into question the effectiveness of regulation FD, or fair disclosure, from the Security and Exchange Commission, which is designed to prevent the selective release of news material to some of a company’s investors before it’s publicly revealed to all.

U.S. taxpayers have invested $120 billion in the U.S. auto industry, with GM representing $50 billion of that amount. Management changes are without question material.

This place needs some stability,” Whitacre said. “And I guess that’s me.”

The announcement comes just before President Obama’s first State of the Union address this Wednesday. Obama, whose ratings among independent voters are plummeting, is expected continue his recent themes of attacking Wall Street banking plutocrats, some of whom were responsible for the wildly unpopular bailouts of the financial industry, as well as the taxpayer-subsidized reorganizations of GM, Chrysler and GMAC, among other loss-making concerns in the automobile business.

Last week GM announced that a consummate Wall Street banking insider, Stephen Girsky, is being paid almost $1 million a year.

U.S. taxpayers are outraged, to put it mildly, over the billions in Wall Street welfare payments they involuntarily made, which are now being recycled to financial executives in the form of multi-million dollar bonuses. A clear majority are also against the auto bailouts. The banking bonus bumble is made more outrageous with U.S. unemployment at 10% nationally growing to levels unseen since the Great Depression.

Whitacre said his salary has not been determined yet, and added that he didn’t accept the job for “personal gain.”

He also was vague about other terms of the deal as discussed with the Board.

“I told the board that I would take it. We didn’t assign a specific time to it,” said Whitacre. “And I can’t tell you if it is two years or three years, but it will be long enough to get to where we need to go.”“I think this company is good for America. I think America needs this,” he said.

Whitacre said, “We’ve made significant progress in the past couple of months, so much so that I can confirm with certainty that we will pay back in full the U.S. Treasury and Canadian and Ontario government loans by June,” Whitacre said.

“This represents a significant milestone in our journey back to being a profitable and viable company.” Whitacre said.

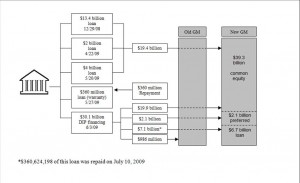

The loans are only a small part of the funds that U.S. and Canadian taxpayers have advanced, roughly $60 billion in total.

The “loans” are less then $9 billion in total, the balance of funds is held by taxpayers in preferred and common stock.

In order for taxpayers to recoup their investment, GM must return to profitability and successfully reestablish itself as a publicly traded company so that the U.S. and Canadian governments can sell their holdings.

A recent Inspector General report to Congress said that taxpayers have little chance of recovering their investment GM (or Chrysler) since the new stock when issued would have to trade above historical highs of the stock of the old, now failed, companies.

In GM’s latest quarter since emerging from bankruptcy, the reorganized company lost $1.2 billion.