It’s the 800 pound gorilla or, if you prefer, “the big dog,” in the words of General Motors President Mark Reuss. But whatever you call it, there’s a lot riding on the success of the automaker’s Chevrolet division, perhaps more than at any time since the 1960s, when Chevy alone accounted for nearly a third of the American automotive market.

(Click here for our first look at the Chevrolet Silverado HD.)

Like the very fate of GM itself, suggests the division’s general manager, Jim Campbell, who says that, “As goes Chevy, so goes GM.” And that’s all the more true as the automaker enters the first spring selling season after its bankruptcy.

Since the earliest days, Chevrolet has been the biggest and most powerful of General Motors brands, but today, it is part of a company that’s been pared back from eight North American divisions to just four. And even though Cadillac, Buick and GMC will have to bulk up, Chevy’s share of overall GM sales will be expected to grow from 60% to “a bit over 70%, this year,” the executive explains.

Getting there won’t be easy. Campbell is refreshingly candid when discussing the problems that drove General Motors into Chapter 11. And he admits there is a large segment of the American population that remains skeptical about the company, and the Chevy brand, in particular.

Outside arbiters, like J.D. Power and Associates how definite improvements in quality and reliability, though the carmaker still lags its cross-town rival, Ford, as well as import benchmarkets, such as Honda. Of course it helps, Campbell crows, to have plenty of third-party endorsements coming in for the latest Chevy products, in particular, the Malibu sedan, Camaro pony car, and Equinox crossover, all of which are on the Consumer Reports “Recommended Buy” list.

At the same time, the influential magazine has pulled its endorsement of eight key products from GM’s toughest competitor, Toyota, which is enveloped in a safety crisis. Like other industry experts, Campbell admits it’s just too early to tell what impact the recall of products like the midsize Camry sedan and Prius hybrid will have on Toyota, though it couldn’t happen at a better time, GM insiders privately believe.

For the record, GM officials insist they’re not going to take advantage of Toyota’s problems. But that stance is questionable.

The automaker recently launched an incentive program directly targeted at its Japanese rival and even before the latest recalls, Chevy switched advertising strategies, abandoning the classic scenes of cars racing along picturesque highways in favor of direct comparisons of products like Malibu and Camry.

Going forward, Chevy is shifting from a strategy of delivering a car for every possible segment and buyer. Instead, it hopes to target five key audiences that still make up a significant share of the American market. These include:

- Traditional truck buyers, with vehicles like the Silverado pickup and Suburban SUV;

- The muscle car segment, with the Camaro and Corvette;

- Fuel-economy enthusiasts, with models like the next-generation Aveo and the upcoming Volt extended-range electric vehicle — which many anticipate to be the single most important launch GM has had in years;

- Young buyers, with a procession of hip, downsized models, such as the Spark minicar; and

- Modern families, with products like the well-reviewed Equinox crossover.

There are some holes in the line-up, Campbell concedes. For one thing, there’s no minivan, a product line GM abandoned a few years back after years of lackkluster success. Campbell cautions that GM may not get back into the minivan segment anytime soon, but it is looking at a commercial van that could answer Ford’s recent addition of the Transit Connect.

Like Ford, Chevy could turn to its European operations to source the necessary product, possibly opting for a Movano-like van that has proven so successful for it on the other side of the Atlantic.

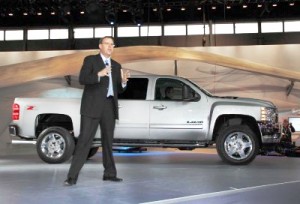

Chevy is also looking to move up in size with its full-size pickups. It introduced a Heavy Duty version of the Silverado at this year’s Chicago Auto Show but could move even larger now that GM has sold off its medium-duty truck operations.

What is not in the cards, stresses Campbell, is a light-duty diesel, at least not for anything other than the Silverado. But there is a footnote to that declaration. “We have the expertise” in Europe, sahs the Chevy general manager, and could add diesels to a broader range of products “if the environment changes.”

Ironically, Chevy’s “biggest problem,” says Campbell is something it hasn’t had to worry about much in recent years. Some of those new products are proving unexpectedly successful, leaving dealers struggling to meet demand for models like the Malibu, Camaro and Equinox.

In years past, the automaker would have rushed to ramp up production, but Campbell cautions, “We run a leaner system now, to improve efficiency.” That means missing a few sales rather than risking over-expansion of production capacity – one of the mistakes that helped drive GM into bankruptcy.

But some relief seems likely to come in the months ahead. GM President Reuss has already approved some third-shift operations and more are expected to follow – if Campbell and his team can maintain demand.

It won’t be easy, especially in a market still down by more than a third from the 17 million peaks of the last decade.

So the coming year will be a real test for Chevrolet, and for GM as a whole. The days are long gone when Chevy dominates the market the way it did a half-century ago. But it is still a force to be reckoned with — or has to be. If this Big Dog won’t hunt, General Motors is likely to go very hungry.