In a ceremony at GM’s Fairfax, Kansas plant late this morning, Chairman and CEO Ed Whitacre said that GM has made its final payment of $5.8 billion to the U.S. Treasury and Export Development Canada, paying back the cash part of its government loans in full, and ahead of schedule.

This confirmed news reports earlier this week that the company would do so in an attempt to remove the right wing stigma of “Government Motors” from the vocabulary of critics and more importantly potential buyers.

Ken Zino, editor of TDB, had an exclusive report – see Limbaugh Carrier Airs GM Loan Repayment Ad – about how a right wing talk radio station revealed the payback ahead of the announcement by running a taxpayer paid spot, many versions of which are now airing on TV and radio stations. Presumably, print ads will follow tomorrow.

The announcement came along with the promise of an investment of $257 million at the Fairfax and Detroit Hamtramck assembly centers.

The money will prepare Fairfax to build the next generation Chevrolet Malibu, and make Detroit Hamtramck a second source for Malibu. This is an optimistic step taken to “ensure that Chevrolet can meet demand” for its new mid-size sedan.

Whether such demand appears remains to be seen.

However, in fairness, GM’s recent product launches have been more successful than the previous ones leading up to its bankruptcy last year.

GM is able to repay the taxpayers in full, with interest, ahead of schedule, because more customers are buying vehicles such as the Chevrolet Malibu and Buick LaCrosse “we build here in Fairfax,” said Whitacre.

Follow the money

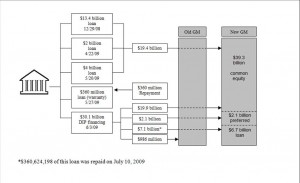

The U.S., Canadian, and Ontario governments, as part of the launch of the new GM, provided controversial loans of $8.4 billion and took large equity stakes in the new company. Today’s payment of $5.8 billion ($4.7 billion to the U.S. Treasury and $C1.1 billion to Export Development Canada) completes the payback of these loans, but does not get taxpayers or GM off the hook.

Under the loan terms, GM had until 2015 to repay the cash part of the loan it closed out today. Overall, this return of what now totals ~$8.4 billion is only a small portion of the actual amount due to taxpayers, who fronted roughly $50 billion in the U.S. alone. For the balance due, taxpayers instead own a 61% stake in the privately held company, and a successful public offering or IPO remains crucial to the government getting its money back – as it subsequently sells or attempts to sell the stock to private investors.

Multiple studies, of course, have said that taxpayers will never recover what was actually invested in GM. See Taxpayers Will Take Big Losses on Auto Bailouts.

However, the same was said about an earlier taxpayer investment in Chrysler Corporation, under the pugnacious Lido Anthony Iacocca, who paid back every cent with interest.

“We appreciate the support the taxpayers have given GM, and our great new products are tangible results of that support,” said Whitacre, who lacks Iaccoca’s automotive sales background and his track record.

My analysis of tax payer returns – or lack of , is based on the value of General Motors Company used by the Federal bankruptcy court in New York, which estimated that the market capitalization (the price of all outstanding shares) of the new GM would be worth between $59 and $77 billion in 2012. Treasury has invested a combined $49.5 billion in the New and Old GM and holds approximately 61% of the private shares or equity in General Motors Company.

Assuming the now full repayment of the cash note by the new GM Company to Treasury, the preferred and common shares in General Motors Company will have to be worth ~$41 billion for Treasury’s investment to be repaid when or if Treasury sells its shares.

This means the market capitalization of the entire company needs to be worth ~$68 billion. (There’s some rounding and currency value issues in my analysis. Like EPA estimates, your analysis may vary.) In April 2008, when “old GM shares” were at the height of their value, not adjusted for inflation, the company’s total value was only $57.2 billion.

IPO depends on sales and outlook for GM

Sales for GM’s four brands are up 36% through March versus the same period in 2009, but still lag industry growth, though many newly introduced cars and crossovers, including Chevy Equinox, Camaro and Traverse; GMC Terrain and Acadia; Buick LaCrosse; and Cadillac SRX remain in short supply at GM dealers.

The Fairfax plant currently builds two of GM’s strongest selling cars, the Chevy Malibu and Buick LaCrosse. For the first three months of this year, GM’s U.S. dealers delivered more than 49,000 Malibu and 14,000 LaCrosse models, representing a 58% increase over the same period last year when it was apparent that GM was insolvent and its future in doubt. These remain very modest numbers when compared to the top sellers in the segments.

Fairfax in February added a third shift of approximately 1,050 jobs, bringing total employment at the plant to more than 3,800.

Fairfax will become the primary source for the next generation of the Malibu. Detroit Hamtramck, which also builds the Buick Lucerne and Cadillac DTS, will be equipped to build the Malibu as well. Detroit Hamtramck will also build the Chevy Volt electric vehicle with extended range, which launches this year, and the Opel Ampera.

The Malibu-related investments of $136 million in Fairfax and $121 million in Detroit Hamtramck will include facilities, machinery and equipment, and tools.