The Daimler AG annual meetings have a long history of dragging on as shareholders use the forum to voice opinions about the failings of company’s management — and the 2010 meeting was no exception. But the key question, this year, is one that could come to haunt the company an its primary brand, Mercedes-Benz.

“It seems to me our company is suffering from an identity crisis,” said one frustrated shareholder during the 4-hour session, wondering a loud about Daimler’s seemingly schizophrenic strategy.

On the one hand, the company wants to keep selling high-end luxury cars – it really, really does and really doesn’t have much choice. But on the other hand, Mercedes-Benz seems committed to the development of smaller cars and greener vehicles as quickly as possible — something the new deal with the Renault-Nissan Alliance underscores.

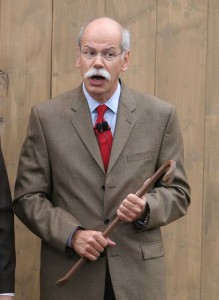

Daimler chief executive officer Dieter Zetsche also repeatedly asserted that the German automaker was ahead of all competitors in developing the new technology that will be required to remain the world’s top luxury brand in the years to come. But shareholders at the Berlin meeting clearly weren’t impressed.

Over the past 15-years, Mercedes has repeatedly tried to maneuver into the smaller car segments without much success, they noted. Indeed, it’s as if the ghost of the Cadillac Cimarron had moved abroad and taken up residence in Stuttgart.

Moreover, the deal with Renault came about because Zetsche had told shareholders during an earlier annual meeting Daimler was in the process of developing a comprehensive plan to end the continuing losses at its Smart car division. So, in some respects Daimler ‘s critical shareholders have only gotten what they demanded.

However, Renault, while making several generations of cars that fit well into the modest end of the vehicle market, has never exactly been an earnings powerhouse. Indeed in the late 1950s, when the French government was the company’s principal owner, it has been reported that the country actually made more money from Bridget Bardot movies than off Renault cars. Though possibly apocryphal, that goes a long way towards explain the skepticism about the deal among Daimler shareholders and in the German press.

Several shareholders scornfully noted Daimler now intends to install small Renault motors not only in the Smart cars but also the Mercedes A- and B-Class models, which by necessity will account for a steadily growing share of Mercedes-Benz sales. (And could they eventually move up into the larger C-class, as well, as Mercedes-Benz struggles to meet new European Union emission standards?)

Zetsche, however, insisted that Daimler’s board of management had everything under tight control. It intended to continue building the world’s best luxury vehicles without any compromises even as it developed the green cars of the future.

“Daimler aims to be, and will be, a pioneer in the field of electric mobility and I can assure you that when alternative drive systems go into mass production in a few years, we will be ahead of the competition,” the CEO asserted.

At the same time, the greater the challenges the lower the probability of dealing with them on our own,” Zetsche added in perhaps the most telling line in his entire address to shareholders.

However, shareholders noted that Evonik, Mercedes’ key battery partner, is already considered an also-ran in the competition to develop next-generation automotive batteries. Chinese, Japanese, Korean and American companies are already well ahead of Evonik.

Even Daimler’s new alliance with China’s BYD may never really get off the ground, as Chinese companies sign lots of memorandums but very few every bear any fruit, one Daimler official ruefully noted.

For a long time, Daimler executives believed buyers of Mercedes-Benz vehicles weren’t much interested in environmental issues and they were probably right. But it also left the company blind or indifferent to the potential threat from a combination of rising fuel-prices, tougher governmental regulations and changing consumer preferences.

Shareholders probably have a right to be skeptical.