The solid performance of new models like the 2010 Mustang and Focus helped Ford earn the rank of top mainstream brand in the 2010 J.D. Power IQS.

For the first time in its history, the influential J.D. Power Initial Quality Study shows that domestic auto brands have, overall, pushed past their import rivals.

Detroit makers, on the whole, showed substantial improvement in the 2010 IQS, which measured out-of-the-factory quality for the latest crop of cars, trucks and crossovers. Ford, in particular, dominates the latest study, and nudges aside such stalwarts as Honda and Toyota to rank as the highest-quality mainstream brand.

The results reflect the impact of recent events, including Toyota’s safety-related recalls. But the findings also come in sharp contrast to public perception in the wake of last year’s bankruptcies by two of Detroit’s Big Three, Power officials note.

“This year may mark a key turning point for U.S. brands as they continue to fight the battle against lingering negative perceptions of their quality,” suggests David Sargent, Power’s vice president of global vehicle research.

Sargent stresses that there is still “a long road ahead” for Detroit’s Big Three. The challenge, he emphasizes, is for Ford, General Motors and Chrysler to “consistently prove to consumers that they can produce models with quality that equals or beats that of the import brands.”

That, analysts stress, may be the toughest challenge of all: getting American buyers to believe the latest results. But Power data show that perceptions may be changing.

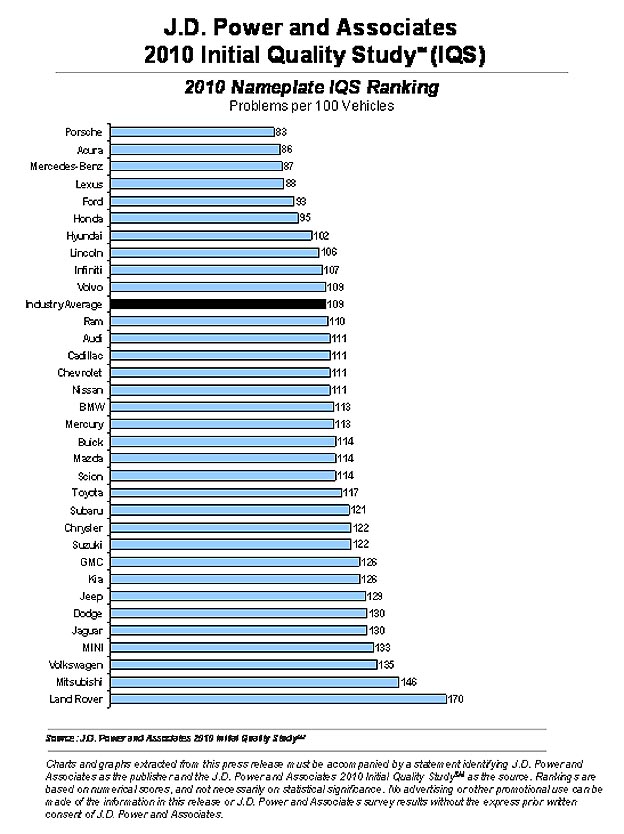

Overall, Detroit’s makers experienced 108 problems for every 100 vehicles (108 PP100) included in the 2010 IQS. The imports averaged 109 PP100. Detroit’s strong showing – after lagging the imports for 24 years – reflects substantial improvement in quality by a number of domestic models, including the Ford Focus, Ram 1500 LD and Buick Enclave.

But Ford was the real powerhouse in Detroit’s breakthrough. The second-largest domestic automaker placed 12 of its models within the top three in their respective product segments for 2010, including the updated 2010 Mustang. That’s more than any other manufacturer, though GM came close, with 10 Top Three models. (The figure for Ford includes Volvo, the Swedish-based carmaker it just sold to China’s Geely.)

GM, however, does have its problems, most of its brands suffering at least marginal increases in reported quality problems. The problem is largely due to the large number of new model launches the automaker had for 2010, some of the higher-volume offerings, such as the Cadillac SRX and Chevrolet Camaro, had problems early on that impacted the various GM brands.

Porsche is the top nameplate overall, its limited line-up of high-performance sports cars and SUVs averaging just 83 problems per 100. Acura scores a significant coupe, jumping from 14th position last year to second for 2010. Mercedes-Benz jumps from sixth to third, followed by Lexus and Ford – the Detroit maker moving into the Top Five for the first time and positioning itself as the best of the mainstream brands.

The Lexus LS is ranked the highest-quality product in the industry, with a miniscule 55 problems per 100, the equivalent of having barely every other owner check something on the lengthy Power IQS survey form.

While its luxury brand was able to hang onto its top-tier spot, Toyota itself plunged from sixth in the 2009 IQS to 21st this year, notes Sargent. The last time the maker dropped below average was in 1998, when it ranked 13th. “Clearly, Toyota has endured a difficult year,” he says, pointing to an unusual 16 problem increase, which means that for 2010, Toyota products average 117 PP100, compared with an industry average of 109. The Japanese maker’s hip Scion brand does only slightly better, with a score of 114 PP100.

On the positive side, Lexus and Toyota together took six of 20 vehicle segment awards, more than any other manufacturer, but “of course we’re concerned,” said spokesman Curt McAllister. “We knew there’d be a drop (since the Power study) was done during the height of the recalls,” but the degree of the drop appears to have taken the maker by surprise.

Mini is the most improved brand in the study, reducing its problem count by 32 per 100 vehicles. But at 133 PP100, the British marque is still fourth-lowest in the latest IQS, ahead of only Volkswagen, Mitsubishi and bottom-ranked Land Rover.

If anything, Detroit’s performance would be even better were it not for GM’s launch problems and the continuing troubles at the domestic laggard, Chrysler, whose four brands all score below the industry average – though the newest of those marques, the Ram truck division, comes in at 110 PP100, just a point under the average. On the positive side, Sargent stressed that all Chrysler brands actually are showing improvements and could help the domestics do even better in 2011.

While luxury nameplates like Porsche and Mercedes dominate the top ranks of the 2010 IQS, a number of high-line brands score below – sometimes well below – industry average, starting with Audi and Cadillac at 111 PP100, and including BMW (at 113), Jaguar (at 130), and Land Rover, at a sizable 170.

The 2010 IQS stands conventional wisdom on its head, and in a number of ways. Traditionally, motorists had to be wary of buying products during their first year on the market, anticipating a higher level of quality problems. That remained true for many GM models, but not across the industry. The latest launches from Ford, Honda, Lexus, Mercedes-Benz and Porsche show that isn’t a hard and fast rule. Ford’s redesigned Mustang and Taurus models, the latest version of the Lexus GX 460 and the all-new Honda Accord Crosstour all top their respective segments. Ford’s Fusion, the Mercedes-Benz E-Class and the new Porsche Panamera also score well.

Overall, more than half of the new or significantly updated models launched for 2010 score at or better than their segment averages. Considering the fast pace of product development in today’s hotly competitive market, says Sargent, “hitting the quality mark out of the gate is critical.”

The industry average of 109 PP100 is actually a “marginal” decline from 2009, notes Sargent, when the score was 108. But it comes as an unexpected break in an almost steady series of 5% to 6% annual gains in the IQS for much of the study’s history. Considering all the disruptions the industry has suffered over the last couple years that might not be quite as much of a surprise. For his part, Sargent says he expects the makers to get back on track in time for the 2011 IQS.

The annual IQS also recognizes the best plants in the industry, and the Platinum Plant Quality Award goes to the Daimler factory in East London, South Africa, which produces the maker’s C-Class. The plant averaged just 28 problems per 100 – though the number is a bit misleading.

On a plant level, Power only looks at defects, not at design issues. When ranking individual vehicles, a poorly-positioned cupholder is considered as much a problem as a defective transmission, a methodology that has frequently come under criticism. But Sargent defends that approach contending a problem is a problem in the eyes of a consumer.

A total of 82,000 buyers and lessees participated in the 2010 Initial Quality Study, responding to a battery of 228 individual questions. The IQS looks at quality of current model-year products after approximately 90 days of ownership.