June new vehicle sales in the U.S. will drop significantly from what was a weak month of May, according to J.D. Power and Associates.

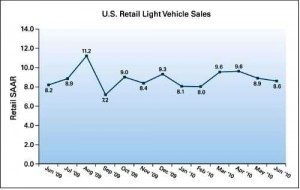

New-vehicle retail sales are expected to come in at 768,000 units, which represents a seasonally adjusted annualized rate (SAAR) of just 8.6 million units. This means June’s selling rate is expected to be down from May’s selling rate of 8.9 million units, but up from a selling rate of 8.2 million units in June 2009. Retail transactions are the most accurate measurement of true underlying consumer demand for new vehicles.

.

| U.S. Retail SAAR June 2010 | |||

| June 2010 | May 2010 | June 2009 | |

| New retail sales | 768,000 units (5% higher June 09) | 847,138 units | 730,627 units |

| Total sales | 971,000 units(13% higher June 09) | 1,100,565 units | 857,952 units |

| Retail SAAR | 8.6 million units | 8.9 million units | 8.2 million units |

| Total SAAR | 10.9 million units | 11.5 million units | 9.7 million units |

| J.D. Power and Associates U.S. Sales. Forecast based on first 16 selling days. | |||

.

An increase in fleet sales in June is not strong enough to offset weaker-than-expected retail sales, resulting in a decline in the total new-vehicle selling rate. Fleet sales are projected to total 203,000 units, up 59% from 2009. As a result, total light-vehicle sales for June are expected to come in 971,000 units, up 13% from one year ago.

“With the improving economic environment, retail sales should be stronger than they currently are, but June marks the second consecutive month with a selling rate below 9 million units,” said Jeff Schuster, executive director of global forecasting at Power, which gathers real-time transaction data from more than 8,900 retail franchisees throughout the United States. “In spite of the more favorable conditions, it appears that consumers remain skittish and have yet to respond by buying vehicles at expected levels.”

Given the continued weakness in the retail market, Power is decreasing its retail sales forecast slightly to 9.5 million units (from 9.7 million units). The forecast for total sales remains at 11.8 million units.

“With the recovery not progressing as expected, it’s gut-check time for the automotive industry,” said Schuster. “The industry’s discipline will be put to the test even more in the coming months if a more pronounced recovery doesn’t get underway.”

Production up

Despite wavering sales, North American vehicle production continues to experience significant increases in year-over-year volume. Light-vehicle production in May 2010 totaled more than 1 million units, up 85% from May 2009. Production in June is expected to be strong, with the second quarter ending at 3 million units, up 68% compared with the same period in 2009.

Inventory levels remain good, with days supply at the end of May decreasing to 49 days, 8 days lower than at the end of April. As a result, the forecast for North American light-vehicle production in 2010 has increased to 11.4 million units (from 11.2 million units), up 34% from 2009.