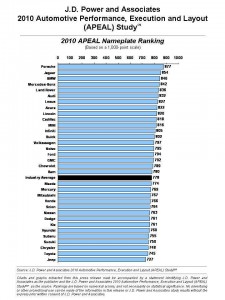

For the first time since 1997, domestic auto brands surpassed import brands as a whole in vehicle appeal, according to the J.D. Power and Associates 2010 Automotive Performance, Execution and Layout Study released today. (See the chart at the end of the story.)

In 2010, the APEAL score for U.S. domestic brands averages 787 on a 1,000-point scale. This is 13 points higher than the score for offshore brands, defined as automakers headquartered in Europe or Asia Pacific. By comparison, in 2009, import brands outpaced domestic brands by five points. This 18-point swing is statistically relevant, and is the latest sign that Detroit makers, notably Ford Motor Company and General Motors Company are improving their products at a time when offshore brands, Toyota in particular, are having well publicized problems. (See American Automakers Dominate AutoPacific’s “Ideal Vehicles”)

Toyota finished second to last among makers with only Jeep ranked at 33rd below it. Of the Chrysler Group brands, only Ram truck finished above average and Chrysler itself finished 31st. To be fair, Toyota has never done well in the survey – last year it finished in the same 32nd spot – since its buyers are looking more for quality and durability, which the survey is not designed to measure.

In another Power study that does track quality, there is more good news for Detroit makers since the Initial Quality Survey released last month shows that Detroit makers, on the whole, made substantial improvement in the 2010, which measured out-of-the-factory quality for the latest cars, trucks and crossovers. Ford, in particular, dominates the latest study, and moves aside such stalwarts as Honda and Toyota to rank as the highest-quality mainstream brand.

Overall, Detroit’s makers experienced 108 problems for every 100 vehicles (108 pp 100) included in the 2010 IQS. The imports averaged 109 pp 100. Detroit’s strong showing – after lagging the imports for 24 years – reflects substantial improvement in quality by a number of domestic models, including the Ford Focus, Ram 1500 LD and Buick Enclave. (See Detroit Taking Quality Lead, Reports JD Power)

“The simplification of the model lineups at domestic makers have allowed them to stay more focused,” Steve Witten of Power told TDB. “This is evident in both increasing IQS and APEAL scores.”

Offshore brands dominate luxury ratings

However, among premium models, import nameplates continue to retain a notable edge, including Toyota’s Lexus luxury division, which finished seventh, ahead of Acura, Lincoln, Cadillac, and Infiniti, among others. Porsche remains the highest-ranking nameplate in APEAL for a sixth consecutive year.

Suzuki improved more than any other nameplate in 2010, compared with 2009, at a time when some analysts are questioning the viability of the low-selling brand in the U.S.

There appears to be nothing atypical in the report. Detroit brands have been improving steadily in APEAL during the past four years, with the greatest improvement occurring between 2008 and 2010. The improvement in 2010 is attributed by Power primarily to high-performing models from Ford and General Motors including several models that are all new or have undergone major redesigns.

“Domestic automakers have performed three important actions during the past two years that have led to their gains,” said David Sargent, vice president of global vehicle research at J.D. Power and Associates. “Firstly, they have retired many models that demonstrated low appeal. They have also introduced new, highly appealing models to their lineups, and finally, they have improved their existing models through freshening and redesigns.”

New models introduced by import brands between 2008 and 2010 have similar APEAL scores as models retired by these import automakers during the same period (averaging 784 vs. 781, respectively). In contrast, newly introduced domestic models have “strongly outperformed” the models retired by domestic brands (803 vs. 758, on average).

Historically, vehicle models achieving high APEAL scores have been shown to generate faster sales, higher profit margins, and a reduced need for cash incentives. High levels of vehicle APEAL also have a strong influence on customer recommendation rates. Among the most highly satisfied owners (APEAL scores averaging 950 or higher), 97% say they “definitely will” recommend their vehicle. However, among the least-satisfied owners (scores averaging below 400), only 8% say the same.

“When new-vehicle buyers go through the shopping process, vehicle appeal, along with price and perceptions of quality, is of major importance,” said Sargent. “Attributes such as exterior styling are primary determinants of whether a model makes the customer’s consideration list in the first place, while other attributes—particularly those related to the interior of the vehicle—are critical in determining which model is ultimately purchased.”

The APEAL Study examines how gratifying a new vehicle is to own and drive, based on owner evaluations of more than 80 vehicle attributes. The 2010 APEAL Study is based on responses gathered between February and May 2010 from more than 76,000 purchasers and lessees of new 2010 model-year cars and trucks who were surveyed after the first 90 days of ownership. The APEAL Study complements the recently released J.D. Power and Associates Initial Quality Study, which focuses on problems experienced by owners during the first 90 days of ownership.