It’s no secret that indigenous Chinese automakers are not competitive with western ones when it comes to existing manufacturing prowess, quality and vehicle design.

That’s the reason the Communist party with its lock on the Central Government in Beijing made a series of industrial policy decisions during the past two decades that forced the most successful foreign automakers and suppliers to establish joint ventures, if they wanted access to what is now the world’s largest vehicle market.

It is arguably the world’s largest self help program, with the express goal of becoming competitive in the auto business without requiring the more than 100 years of learning accrued in the west.

Beijing leaders are now looking at and taking decisions on the next steps – how to establish leadership in emerging technologies that the Chinese can dominate in the home market and export globally, as China consolidates the industry and forces the foreign companies into smaller roles.

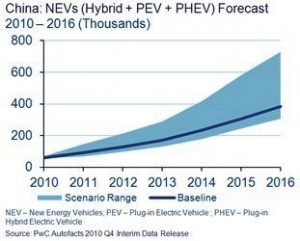

There are two primary reasons for a new and ambitious Chinese plan to concentrate on hybrid and electric vehicle technologies, according to an analyst report by the consultancy PriceWaterhouseCoopers.

First, like the U.S., China is vulnerable because it imports more than half of its oil now; a percentage that will increase dramatically in the decades ahead as it grows. And, second, air quality in China is so bad that it can seen on satellite photos as its drifts into other regions – a new take on poisoning your neighbor’s well, since the Chinese are poisoning themselves at the same time.

Because hybrids are known to improve fuel economy significantly, promoting their local production is an obvious policy decision. And of course there is no love lost between China and Japan, whose Toyota and Honda automakers lead in the technology.

Electric vehicles are a more complex issue. Much of China’s electricity is produced burning coal, which is an environmental disaster, but in abundant supply there.

To accelerate EV and hybrid development cycles, the Chinese are actively pursuing partnerships or acquisitions to secure technology in both battery and electric components, according to PWC.

This is understandable since China is now the world’s largest battery producer for consumer electronics. From a western point of view, the fact that China has an estimated 27% of global lithium and 80% neodymium reserves – both essential materials to batteries for electric vehicles – is frightening.

To encourage hybrid and EV development, China’s key ministries have sponsored an ambitious plan to promote adoption of them in government fleets in 13 congested cities, with lavish subsidies of more than $8,000. The government also approved new EV standards last spring, and on June 1st launched another pilot program to offer consumers from five cities a subsidy of up to $8,800 to purchase them.