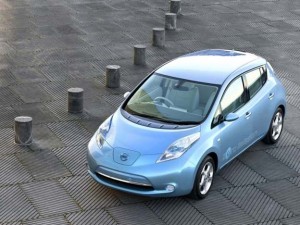

Will consumers plug into battery vehicles, like the 2011 Nissan Leaf? A new study suggests demand will lag the hype.

Even when combining conventional hybrids with more advanced plug-ins and pure battery-electric vehicles, or BEVs, Power’s new Drive Green study projects that demand for all forms of battery-based vehicles will account for only 7.3% of the total worldwide automotive market by 2020.

But Power researchers acknowledge that their forecast contains a number of variables and several key unknowns could dramatically change what happens over the coming decade.

“The most likely scenario” leading to significantly greater interest in battery power, said senior Power analyst Dave Sargent, “would be a dramatic and sustained increase in gasoline prices.”

According to Drive Green, hybrids, or HEVs, and BEVs will account for 5.2 million of the 70.9 million cars, trucks and crossovers Power expects to be sold worldwide by 2020. That compares with 954,000 battery vehicles expected to be sold through the end of this year, 2.2% of the total worldwide market of 44.7 million vehicles.

While battery propulsion may be making great headlines and generating a lot of buzz – and investment – within the auto industry, Sargent says, “The people who are least interested are consumers,” especially after they hear the downside of battery technology.

Demand will vary by market, Power forecasts. U.S. motorists will be drawn to hybrids, rather than battery cars.

For purposes of the study, Power estimated an initial $5,000 premium for hybrids when compared to comparable vehicles using conventional gasoline propulsion, and $15,000 for battery cars.

“Theoretically, interest is high” among consumers, said Sargent, but when you talk to consumers about the price premium and the level of performance (notably the limited range of BEVs), interest drops off rather quickly.”

The Drive Green study projects that different technologies will gain ground in each major world market.

Hybrid power will become most popular in the United States, according to the forecast, accounting for 1.7 million sales a year by 2020. In Europe, the technology will generate 977,000 sales, and in Japan, Power forecasts, the figure will come to 875,000. China will be relatively uninterested in gasoline-electric propulsion, with sales projected at only 100,000 by 2020.

On the other hand, demand for pure battery-electric vehicles will be relatively low in the U.S. and Japan, at an estimated 100,000 sales for each of the two markets. But European motorists will snap up 742,000 BEVs, and China’s buyers 332,000, according to Drive Green.

That reflects both psychic and real world needs, said Sargent, during an interview with TheDetroitBureau.com.

“Americans tend to drive long distances and thus tend to have more range anxiety,” he said, even though federal data shows that on a typical day the average American could more than get by on the 100-mile range of a BEV like the 2011 Nissan Leaf.

“In Europe,” however, “where people tend to drive shorter distances….and are happy to jump on a train or plane for a longer trip….battery cars tend to better fit their lifestyle.”

The Power forecast is on the low side of battery technology prognostications, though most analysts have tended to punch out numbers ranging from 5% to 10% of worldwide demand at the end of the coming decade. But some, like Carlos Ghosn, the battery enthusiast who heads both Nissan and French affiliate Renault, believe the market could surge to 20% given the right scenarios.

Along with a big bump in petroleum costs, these could include a stiff increase in fuel taxes. And a substantial increase in government support would also help drive up demand, Sargent suggested, something he sees most likely in a command-and-control economy like China’s.

Proponents of electric propulsion also project the likelihood of a sharp decline in the price of battery technology. While lithium-ion batteries currently run in the range of $800 to $1000 per kilowatt-hour, that could drop to as low as $200 to $400 by 2020, according to various forecasts, including one released earlier in the year by the Boston Consulting Group. For a BEV using 24 kWh of batteries, that could trim costs by as much as $20,000 a vehicle.

But Power’s Sargent says the industry is facing “a Catch-22 situation.” Unless demand rises significantly there won’t be enough economy of scale to drive down battery costs enough to justify still more reductions in price and increases in demand.