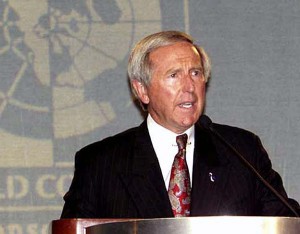

The long trial of former Delphi Chairman and Chief Executive Officer J.T. Battenberg ended with a jury clearing him of fraud – but he was still found him liable for misrepresentation and responsible for accounting errors involving a $237 million payment the supplier made to former parent General Motors.

The Securities and Exchange Commission’s civil complaint against Battenberg alleged that the former Delphi CEO had tried to hide the Dephi’s financial condition in order to improve its performance in the market.

Battenberg faced only civil, rather than criminal charges. He nonetheless sought vindication via a jury trial but now faces a substantial fine and possibly other sanctions.

Battenberg faced only civil, rather than criminal charges. He nonetheless sought vindication via a jury trial but now faces a substantial fine and possibly other sanctions.

He faces no jail time but could be barred from serving on the board of any publicly traded company on top of those fines. It was a serious rebuke to an executive who was considered one of Detroit’s major corporate stars during the 1980s and 1990s.

The SEC’s prosecutors hammered on the idea that Battenberg deliberately deceived outside investors about the handling of an item in the company’s financial filings in the years before Delphi filed for bankruptcy in 2005.

The SEC sued Battenberg and other ex-Delphi executives in 2006, alleging they engaged in “fraudulent accounting or disclosure schemes.” Two other former Delphi executives, Milan Belans, a former director of capital planning and pension analysis; and Catherine Rozanski, a former accounting director, settled with the SEC during the trial. Belans agreed to pay $87,500 in disgorgement, interest and civil penalties, court filings show. Rozanski agreed to a $40,000 civil penalty.

Battenberg’s lawyers repeatedly asserted their client never did anything wrong and said the SEC hadn’t provided evidence to support its claims.

However, during the course of the trial, former Delphi financial staffers testified they were coached by senior executives on how to handle a disputed claim from General Motors.

The SEC maintained Battenberg violated federal securities laws through improper accounting for a $237-million payment Delphi made to GM as part of a settlement involving warranty claims.

Delphi improperly recorded a $202 million payment instead of charging it against income which would have reduced the supplier’s quarterly profit. It also would have reduced the size of executive bonuses, though the bonus payments were not part of the government’s case.

The payment to GM grew out of a long-standing dispute with GM that festered for months after the automaker’s 1999 spinoff of Delphi. The supplier, at the time one of the world’s largest automotive parts manufacturers, repeatedly protested GM’s claims but found it was steadily losing business from GM as the dispute dragged on, Battenberg said, when he took the stand in his own defense last autumn.

Delphi’s financial problems eventually drove the company to file for Chapter 11 reorganization. It only emerged from bankruptcy a year ago, the longest corporate trip through the courts in U.S. history.