As part of a bold transformation, dubbed Jump 2013, that could prove essential for the maker’s survival, Mitsubishi will kill off and replace its entire line-up of U.S.-made models, including the once-popular Eclipse coupe and Endeavor crossover.

An entirely new line of products will be launched to replace the outgoing models, promises CEO Osamu Masuko, who envisions the maker’s assembly line in Normal, Illinois, as a major export center.

Following the lead of other global makers, including Ford Motor Co., Mitsubishi will migrate to fewer flexible global platforms that can be used for a variety of models – both conventionally-powered and others using alternative propulsions systems, according to Masuko, who outlined the plan during a Japanese news conference today.

The Jump 2013 strategy has been a long time in coming and reflects the Japanese maker’s bid to reverse years of setbacks, particularly in the American market, where it has steadily lost ground over the last decade. From a peak for 345,000, sales tumbled to barely 50,000 in recent years. The numbers did rise 3%, to 55,683 last year, but while that was a much hoped-for increase, it lagged well behind the recovery of the overall U.S. market.

“Our sales in North America will increase,” Masuko promised, during the Jump 2013 announcement, though he didn’t provide a specific number. Perhaps for good reason, as the company has repeatedly fallen far short of its targets.

As recently as 2007, Chairman Takashi Nishioka predicted U.S. sales would jump 70%, by 2010, to 200,000. Instead, they fell by more than half.

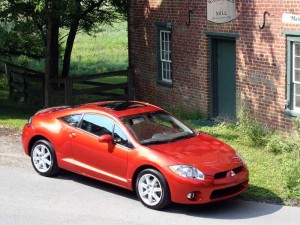

The upcoming transformation will see the end of the once-popular Eclipse coupe, a sporty 2-door that, in its latest incarnation, has failed to generate much enthusiasm in the U.S. or abroad. That and the Endeavor crossover and Galant sedan will be phased out by 2014.

In their place, Mitsubishi says it will introduce a new line of models at the Normal plant – which was originally opened as part of a joint venture between the Japanese maker and its long-time U.S. partner, Chrysler. The partnership between the two has steadily diminished, over the years, and Chrysler will soon phase out the last remnants of that relationship when it replaces the Mitsubishi-engineered 200 sedan with a model using a Fiat platform.

Precisely what Mitsubishi plans to produce in the U.S. it isn’t yet revealing, though the plant will work with a platform that is currently shared by a number of crossovers and passenger cars, including the Lancer sedan and Outlander crossover/SUV. That strategy echoes the general industry trend. Ford, for example, plans to produce as many as 10 different “top hats” – individual body styles, in industry-speak – off the new Global C-Car platform shared by the new Focus sedan and C-Max microvan.

Whatever ultimately rolls off the Illinois assembly line, about half will be earmarked for the U.S., the rest, said Masuko, will be exported to regional markets pegged to the U.S. dollar, replacing the increasingly expensive products that have until now been imported from Japan.

“We have no choice but to produce vehicles close to where demand is and in a way that lowers foreign-exchange risks,” said the CEO of Japan’s sixth-largest automaker.

Those imports won’t entirely end, however, Masuko revealed. Among them will be a new global small car, as well as the American version of Mitsubishi’s new battery-electric car. Marketed in Japan as the iMiEV, it will be sold here as the “I powered by MiEV.”

In all, Mitsubishi plans to introduce eight new battery cars, some pure electrics, like iMiEV, the others using hybrid drivetrains, an increasingly popular technology in which Mitsubishi has lagged behind key Japanese and American competitors.

Still struggling back after a near-fatal financial meltdown triggered, in part, by a flawed U.S. marketing strategy, Mitsubishi is hoping to find new partners to replace Chrysler and help it flesh out its line-up. These include Suzuki and Nissan, the latter exploring the possibility of jointly developing a 1-ton pickup for Mitsubishi.

With emerging markets, notably including India and China, expected to do the bulk of the heavy lifting, Mitsubishi expects to see sales jump 37%, to 1.37 million by the end of the 2013 fiscal year, which wraps up on March 31, 2014. China alone is expected to see sales double from the current year’s anticipated numbers to 500,000.