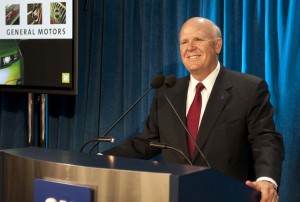

General Motors Chairman and CEO Dan Akerson told clearly nervous investors that the maker’s stock will recover despite hitting its lowest levels since last November’s initial public offering. The company, he insisted, has grown strong after its bankruptcy-led “rebirth.”

Nonetheless, the executive also acknowledged, during the annual GM shareholder’s meeting, that he is himself concerned about the economy and about the rising U.S. deficit.

Separately, the former Navy officer suggested that it’s time to add another dollar to the federal gasoline excise tax, the increase likely to help spur demand for new green vehicles – such as the maker’s plug-in hybrid Chevrolet Volt.

After the 2010 IPO, GM shares initially surged from the $33 strike price, some analysts forecasting the maker’s stock could hit $50 a share before leveling off. But that was before the run-up in fuel prices, and since the stock offering there have been mounting concerns about the deficit and general direction of the U.S. economy. Add the various factors in and GM stock slumped to $28.56 at Monday’s close, its lowest level since the IPO.

(Those shares have today begun a modest recovery.)

“No one said this was going to be a lay-up. There’s a lot of work to be done,” Akerson said during a discussion with reporters prior to the shareholders meeting. “I own stocks for a long period of time when I believe in their management. … I don’t think these get-rich schemes of buying an IPO company is the best way to invest.”

Separately, Akerson expressed concerns about the $14 billion federal deficit, saying steps must be taken to reduce the debt – and calm nervous stock markets.

“It doesn’t mean we have to cure it overnight, but we have to have a 10-year plan,” he said.

Akerson also suggested that if Washington can help nudge the economy into gear it will lead to an increase in jobs. And that will translate into more car sales. After more than a year of growth, U.S. automotive sales tumbled in May – though that was at least partially the result of shortages of Japanese-made vehicles.

Akerson, a strong proponent of the switch to electric propulsion, has been pushing for the expansion of GM’s use of drivetrain technology like that in the Volt. Earlier this week, he dismissed ethanol and downplayed the viability of hydrogen fuel cells. In five years, he suggested, that battery technology will be so prevalent the Chevy Volt will seem like “old news.”

But he has also argued that there needs to be more support for alternative propulsion and Akerson, normally a conservative Republican, steps away from GOP doctrine by calling for an increase in fuel taxes as a way to encourage motorists to shift to alternative technologies.

Akerson had his first chance to address shareholders in his dual role as Chairman and CEO on Tuesday – less than 100 investors gathering in Detroit — the first time GM has held the meeting in its home town since 1990.

The executive acknowledged there are challenges ahead, but laying out an optimistic future as it continued to seek out markets around the world. The Chevrolet and Cadillac brands will serve as the mainstay of that assault, others, including Buick, Opel and GMC, designated regional players.

Akerson also noted that GM plans to exercise its option and will boost its stake in its Chinese alliance with Shanghai-based SAIC to 50%. The U.S. maker had given up control, reducing that to 49%, shortly after emerging from bankruptcy in 2009.

The annual shareholders meeting came almost two years to the day after GM filed for Chapter 11 protection, emerging on July 10, 2009 with the U.S. government holding a roughly two-thirds equity stake. The government sold off half its holdings last November. No specific plan for selling off the remaining shares has been announced, but analysts report that the Treasury holdings would have to go for at least $53 a share to break even.