While its factories are rapidly getting back up to full speed following the devastating March earthquake in Japan, Toyota dealers are struggling to meet demand for the popular Prius with barely a “three to four-day supply” of the world’s best-selling hybrid model, a senior official said.

By comparison, makers consider a 50 to 60-day supply to be normal for most products. The shortfall likely resulted in a 30 to 40% shortfall in sales of the Prius during May, said Toyota’s hybrid marketing manager Ed LaRoque.

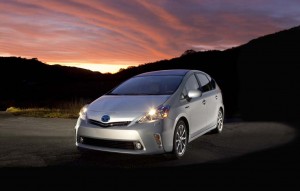

The crisis, which all but shut down Toyota production the first month after the March disaster—and continues to leave its plants running below capacity — has also forced the maker to delay the launch of its new Prius v, the first in a “family” of hybrids to share the same brand identity as the original Toyota model. According to La Roque, the debut of the v, a larger, wagon-like take on the familiar hybrid sedan, will be “a few months behind,” and probably won’t reach U.S. showrooms until around October. The maker is meanwhile hoping to start rebuilding supplies of the original Prius over the next several months.

The Prius v will be followed by a plug-in version of the original hybrid later this year, while a compact, dubbed Prius C, will debut in 2012.

Still other models could eventually wear the new Prius sub-brand badge, hinted LaRoque, who said that the maker has been receiving a wide range of suggestions as to what other hybrid platforms might connect with consumers, including a minivan.

The decision to transform the Prius name into a brand-within-a-brand has alternately been hailed as a marketing coup but also disdained as a way to confuse consumers.

“We’re hoping they’re not going down the same path as Lincoln did by naming everything MK this or MK that,” cautioned Aaron Bragman, of the automotive consultancy IHS. Confusion in the marketplace is one reason, he and others believe, while Lincoln sales have tanked in recent years.

For his part, LaRoque acknowledged it may take time to “educate” consumers about Toyota’s new strategy to make them aware of the new models and their advantages. The carmaker plans to emphasize that the new Prius v delivers significantly more room than the original hybrid, while still delivering more than 40 mpg.

“The ‘v,’ stands for ‘versatility,’” the Toyota executive explained.

In the U.S., anyway, for the new model will be offered in Europe as the Prius+, while Japanese will be able to buy the Prius Alpha. And that’s not the only difference.

The American version of the new hybrid will continue to use the same nickel-metal hydride battery pack found in other Toyota hybrids, including the original Prius and the Camry Hybrid. It will also be offered only in a 2-row, 5-passenger configuration. The rest of the world will get a 3-row, 7-seater thanks to the use of a smaller, more advanced lithium-ion battery pack.

Toyota was long reluctant to adopt the newer battery technology that is also the heart of advanced competitors like the Nissan Lead battery car and Chevrolet Volt plug-in.

“Clearly, lithium-ion is the future,” conceded LaRoque, in an interview following a Detroit preview of the new Prius v. So, “in the near future (we’re) going to be looking at transitioning to lithium-ion,” even for more conventional hybrid models. That, he noted, will begin with the upcoming launch of the Prius Plug-in, which is expected to get about 13 miles per charge on battery power before converting to conventional hybrid mode.

Things have changed dramatically since the launch of the Prius, 11 years ago, when its only competitor was the 2-seat Honda Insight. Today, there are 16 other makers producing hybrids – though, notably, the original Prius currently holds a 50% market share worldwide. That leads many analysts to wonder about the future of the technology.

While sales began picking up steam as U.S. fuel prices soared, earlier this year, hybrid demand began falling by mid-spring – even accounting for the drop in availability of the Prius and other Japanese models. In May, in fact, all hybrids combined generated lower sales than three of Detroit’s popular muscle cars: the Ford Mustang, Chevrolet Camaro and Dodge Challenger.

But analyst Bragman believes that, “eventually,” hybrid sales will pick up, if for no other reason than rising fuel prices and increased federal mileage mandates. By 2016, automakers will have to hit a fleet average of 35.5 mpg, and that could jump as high as 62 mpg by 2025 according to rules now under debate.

Toyota clearly hopes to maintain the lion’s share of that market, LaRoque suggesting, “We could eventually see a point where (various models dubbed) Prius could lead Toyota sales in the U.S.”

Currently, the single, original Prius hybrid is the third best-seller in Toyota’s U.S. line-up, behind the Camry and Corolla.

Last year, it generated 140,000 sales in the States alone, compared with the Japanese maker’s initial, cautious forecast of 11,000 annually – worldwide.

LaRoque said Toyota is still trying to get a clear sense of what demand for the New Prius v will be in the U.S., and is, for the moment, also following a cautious line, projecting it will generate about 15 to 20% of the demand for the older model.

As demand increases, the marketing executive noted, it will also put pressure on Toyota to shift at least some Prius production to the U.S. That was in the plans in 2008, but scrubbed after gas prices tumbled.

Nonetheless, said LaRoque, “If we want to expand and grow” hybrid sales, “we will need production capacity in the U.S.”