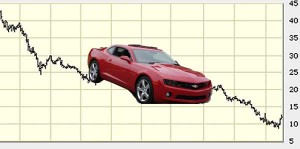

GM stock staged a modest rebound on Friday but it took serious hits for the week - as did most auto-related manufacturers and retailers.

Some of the key automotive stocks ended the week with a modest reprieve after being hammered on markets around the world for most of the week, but the upturn in shares of General Motors, Ford and other auto-related manufacturers and retailers barely begins to make up for the losses they’ve experienced since traders began to panic over fears of a double-dip global recession.

It’s hard to point to any single factor that triggered the week’s sell-off since so many things appear to be going wrong, from the downgrade of Greek banks to the U.S. Federal Reserve’s warning that the economy is likely to take more time than expected to recover.

But in keeping with the old adage that when the economy catches cold the auto industry gets pneumonia, companies like GM, have been among the most hard-hit.

Detroit stocks were among the hardest hit. Ford Motor Co., generally seen as the strongest of the domestic makers, bounced back slightly on Friday but still failed to close above the $10 mark, at $9.86, well below its 52-week high of $18.97.

But General Motors was arguably the poster child for the panic that has swept through the investment community.

There’s no question that the auto industry won’t do as well as many had hoped earlier in the year, most analysts now predicting 2011 will be lucky to bring U.S. sales near the 13 million market. Some had previously anticipated volumes would push as high as 13.5 million or above.

But GM has been posting solid double-digit monthly sales gains and has been able to boost market share, as well, taking advantage of the production problems its Japanese rivals have experienced in the wake of the March 11 earthquake and tsunami that struck northeast Japan.

The maker last week concluded contract talks with the United Auto Workers Union, the 4-year agreement providing $5,000 in signing bonuses to hourly workers, as well as increased profit sharing. Yet Deutsche Bank analyst Rod Lache concluded the productivity gains approved by the UAW would more than make up for those expenditures. Meanwhile, S&P Equity Research analyst Efraim Levy reiterated his own strong buy rating on the stock, saying GM is “poised to take advantage of rising global vehicle demand.

GM also posted a modest Friday gain, up 76 cents to $21.00, but it still lost more than $2 off its peak for the week and is down sharply from a 52-week high of $39.48 – and a $33 price when it staged its successful IPO last November.

Foreign makers didn’t fare much better for the week, Toyota plunging from more than $71 to barely $66 during the week before staging a modest rally of its ADRs on the New York Stock Exchange, finishing the week at $67.85.

One of the few makers to escape in positive territory for the week was California start-up Tesla Motors, which is counting down towards the launch of its new Model S sedan. The maker’s shares fluctuated wildly, from a low of barely $24 on Monday to a peak nudging $27 by mid-week. Then, Tesla started to tumble along with more established makers before staging its own Friday mini-rally. It closed at $26.38, up 75 cents for the day – but still off nearly 30% from its $36.42 52-week high.

If automakers have had their troubles, car parts manufacturers have been even harder hit in many cases. Canadian mega-supplier Magna International was trading at nearly $38 at the start of the day on Tuesday, slipped to barely $31 before licking its wounds and ending the week at $32.31, a 53-cent gain on Friday. Magna had hit a 52-week high of $62.20.

Even the slightest signs of trouble have led investors to race in with sell orders. Retailer CarMax fell 2% short for the second quarter in terms of comparable store used car sales, with profits rising a marginal $4 million, or 1 cent a share, to $11.9 million or 49 cents a share. That sent its stock plunging to $24.12 for the week.

New car dealer giant AutoNation suffered its own sales shortfall for the April – June quarter, numbers announced this past week triggering a sell off that saw the Ft. Lauderdale-based retailer collapse from a $37.54 high to just $32.94 on Friday – its stock one of the few not to see an end-of-the-week rebound.

Despite the hit his firm took, AutoNation CEO is among the more bullish in the industry when it comes to the on-again/off-again automotive turnaround. “The auto recovery is going to resume probably in October,” he asserted during an interview with Reuters, predicting that the industry is “on a journey” that will see it return to the 16 million to 17 million sales numbers not seen in a decade.

Unfortunately, until investors start to see clear signs that the upturn is underway it seems unlikely they will be willing to drive prices back up to peak levels seen only a few months ago.