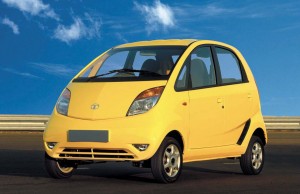

How low can you go? India’s Tata Motors thought it found rock-bottom when it launched the $2,600 Nano several years ago. But it is about to get a run for its money from the new Bajaj RE60, a microcar its manufacturer says is meant to replace the time-honored rickshaw — and which could come in at a price even lower than the Nano’s.

That could be bad news for Tata, which has been struggling to build demand for the stripped-down Nano, which has suffered from an assortment of glitches since its March 2009 introduction. Among other things, it was involved in a series of fires and, most recently, Tata announced it would have to replace the starters in 140,000 of the pint-sized vehicles.

“I don’t consider it a flop,” Ratan Tata, the soon-to-retire chairman of parent company Tata Sons, insisted during a news conference in New Delhi at Auto Expo 2012. “I consider it that we have wasted an opportunity.”

The opportunity to now make the Nano the success originally envisioned will certainly be tested with the launch of the Bajaj RE60.

The good news for Tata, for the moment, at least, is that the ungainly vehicle will be targeted at rickshaw drivers rather than the general public. While that might seem a severe limitation it helps to realize there are over 5 million rickshaws still in use in the world’s second most populous nation – and there are export opportunities to such places as Sri Lanka, as well.

With wheels described as the size of a dinner plate, the new four-door is expected to be only slightly more expensive than a conventional rickshaw, with various observers estimating it will run anywhere from $2,200 to a bit over $3,000. Final figures haven’t been released and it is possible that the company’s competitive founder, Rajiv Bajaj, could, indeed, try to undercut his rival.

He took a shot at Tata in an interview with Forbes India, saying, “I am not sure if the Nano is the cheapest car or god’s gift to two-wheelers but thankfully the RE 60 has a clear position.”

That position is part of what Bajaj describes as a new segment for “four-wheelers.” The RE stands for “Rear Engine,” and the RE60 is relatively conventional when compared with some of the earlier Bajaj 3-wheeled models. “This is a vehicle for all the people who use a three-wheeler almost every day,” explained Bajaj. “It is a four-wheeler which is a dramatic improvement on the three wheeler.”

The RE60 features a 1-cylinder engine good for 82 miles a gallon – about 27 mpg better than the Nano — but the new Bajaj can only make a maximum speed of 43 mph – which it likely will seldom see on the crowded streets of most Indian cities.

Could there be room on those road for both? Certainly, the flood of automotive investment dollars suggests that India could become the next China, currently the world’s largest national automotive market.

But the Indian economy and its automotive industry are growing at a much slower pace. And while Chinese motorists have shown a surprising affinity for relatively western – meaning larger and better-equipped – vehicles, many believe the low end of the market is where the surge in demand will come in India.

The Nano received widespread praise when it first debuted in 2008, the Financial Times proclaiming it, “a triumph of homegrown innovation.” But it wins far fewer kudos today, in part because of its ongoing technical problems and safety scares.

The epidemic of fires nearly halted sales, demand drying up in late 2010 to barely 500 Nanos a month. But sales are slowly regaining momentum and hit 7,466 last month.

“I believe we will see a resurrection of the product as we move forward,” said Ratan Tata.