Wrapping up a series of setbacks, General Motors Co. today reported its net income dropped by 40% in the second quarter to $1.5 billion, or 90 cents per share, as it posted another huge loss by its money-losing European operations.

In the second quarter last year, GM earned $2.5 billion, or $1.54 per share. Net revenue in the second quarter of 2012 also dropped to $37.6 billion, compared with $39.4 billion in the second quarter of 2011. The decrease was due almost entirely to the strengthening of the U.S. dollar versus other major currencies, GM officials said Thursday.

The weak earnings report capped a disastrous week that began when the giant U.S. maker unexpectedly ousted its controversial global marketing chief. Then, on Wednesday, GM announced July sales had dipped even as key foreign competitors, such as Toyota, posted double-digit gains.

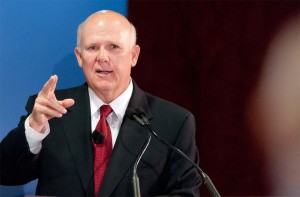

“Our results in North America, our International Operations and at GM Financial were solid but we clearly have more work to do to offset the headwinds we face, especially in regions like Europe and South America,” said GM chairman and chief executive officer Dan Akerson.

Earnings before interest and tax, or EBIT, also fell by a third to $2.1 billion, compared with $3.0 billion in the second quarter of 2011. Total restructuring expenses included in EBIT-adjusted numbers for the second quarter of 2012 was $100 million.

Nonetheless, Akerson tried to put a good spin on the latest results, noting that, “Despite the challenging environment, GM has now achieved 10 consecutive quarters of profitability, which is a milestone the company has not achieved in more than a decade.”

But the series of setbacks GM has suffered in recent days has generated a growing amount of concern about the maker, especially among investors who have been driving down its stock, in recent days, to the lowest levels since the maker’s November 2010 IPO.

For some, the biggest concern is the company’s sales slide despite the launch of some well-reviewed new products, such as the 2013 Chevrolet Malibu and Sonic models.

“GM has given back nearly two points of market share in the second quarter, erasing the gains of last year,” said Jesse Toprak, Vice President of Market Intelligence for TrueCar.com. “Days supply and incentives spending are up, which are both relatively negative trends. The only silver lining is the increase in average transaction prices, which was a result of optimized pricing efforts as well consumers’ preference for highly contented vehicles.”

As part of Thursday’s earnings report, GM North America (GMNA) showed EBIT-adjusted income of $2.0 billion, compared with $2.2 billion in the second quarter of 2011 and GM International Operations, which reflects the company’s business in China, reported EBIT-adjusted of $600 million, equal to the second quarter of 2011.

But the big anchor around the corporation’s neck is its European operations – which have already run up billions of dollars in losses after a dozen years in the red. GM Europe (GME) reported an EBIT-adjusted loss of $400 million, compared with EBIT-adjusted of $0.1 billion in second quarter of 2011 and GM South America reported breakeven results on an EBIT-adjusted basis, compared with EBIT-adjusted of $0.1 billion in the second quarter of 2011. The second quarter 2012 results include $100 million in restructuring expenses.

The maker’s Vice Chairman Steve Girsky recently took over as interim chief executive in Europe following the ouster of Karl-Friedrich Stracke – after less than a year in the job – and a coterie of senior executives. Girsky has been developing a proposed turnaround plan that is expected to see several European plants close. But, due to political issues and the demands of GM’s unions, the process is expected to take several years to implement.

GM Financial earnings before interest and taxes also doubled to $200 million from the $100 million reported in the second quarter of 2011.

For the quarter, automotive cash flow from operating activities was $3.8 billion and automotive free cash flow was $1.7 billion. GM ended the quarter with very strong total automotive liquidity of $38.5 billion. Automotive cash and marketable securities was $32.6 billion, compared with $31.5 billion at the end of the first quarter of 2012.

At the end of the first quarter, GM indicated that GMNA’s results for the second and third quarters of 2012 were expected to be comparable to the first quarter. Second quarter GMNA results were stronger in part due to timing of spending that was deferred to the third quarter. GM continues to expect that the average of its second and third quarter EBIT-adjusted in GMNA will be comparable to first quarter results.

“We’re executing an aggressive product plan around the world, and at the same time we are working systematically to simplify the business and truly leverage our scale to grow our margins,” said Dan Ammann, senior vice president and chief financial officer.

Despite the setbacks suffered this week, analyst Rebecca Lindland, of IHS Automotive stressed that GM’s situation is not as dire as some might suggest, arguing that it would take only a few positive developments to give the maker some upward momentum.

GM is by no means the only automaker facing challenges this summer. Rival Ford saw a 57% dip in its second-quarter earnings, also largely the result of European problems. Several European makers have also seen profits plunge. But the smallest of the American makers, Chrysler, reported a substantial gain for the quarter — helping its Italian alliance partner Fiat offset its own earnings shortfall. And Honda this week saw its April-June numbers quadruple as it recovered from the impact of the devastating earthquake and tsunami that struck Japan in March 2011.

Paul A. Eisenstein contributed to this report.

Good: At GM, people are accountable for their results

Bad: They get clipped the first quarter than things don’t go according to plan

Neutral: Bigger profits / they come from not doing things that are healthy for the corporation.

Net: Dan, who are you going to fire next? Eventually, the Blame Bench is going to be empty except for you.

Analyst Rebecca Lindland summed things up well. It is clear that the old GM system had failed. But

Simply being disruptive is not good enough. There comes a point where constant tumoil makes it impossible to get anything done, whatever the intent.

Paul A. Eisenstein

TheDetroitBureau.com