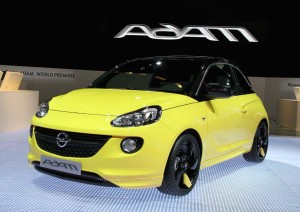

Opel had the rapt attention of its audience as it pulled the covers off the new Adam minicar to help kick off the 2012 Paris Motor Show Thursday morning.

Make that rapped attention, though it was clear by the puzzled look on the faces of most of the journalists attending the early morning preview that the fast-paced presentation by a half-dozen rap artists was a lot more difficult to follow than the usual executive speech.

No matter, the new Opel Adam is aimed at a decidedly different audience – though it could be one of the most important models to emerge from the German maker’s product development studios in a number of years. The Adam is the first of a promised 23 vehicles the General Motors subsidiary will roll out over the next four years in its effort to turnaround years of devastating losses.

If a first glance sparks a sense of déjà vu that’s no surprise. The Adam is clearly aimed at such popular European microcars as the Fiat 500. It boasts a similar, tall hatch-like shape, with a chrome accent line wrapping around the cars “greenhouse.”

It’s different looking. It’s modern. It’s young,” GM Vice Chairman Steve Girsky, who is overseeing the Opel turnaround, told industry analysts prior to the Paris introduction.

The new model is expected by most of those analysts to come in somewhere around 12,000 Euros, which would clearly put it in a position to challenge the little Fiat.

But Opel is expected to offer a bit more content than its Italian competitor – and the GM subsidiary consciously targeted what officials describe as a more “masculine” design than the little 500, or as Italians call it, the Cinquecento. The maker is also offering about 30,000 different exterior design combinations when colors and optional cladding are included.

That could be of particular appeal in Europe, where car buyers are far more likely to custom order their vehicles than in the U.S.

One thing is clear, Opel needs help. The maker lost $361 million in just the second quarter of this year, with industry analysts forecasting losses for all of 2012 could hit anywhere from $1.5 billion to $2 billion depending upon how bad the European market continues to sink. Whatever the final number it would add onto the $16.8 billion Opel has lost since plunging into the red in 1999.

GM has attempted a number of rescue efforts without success and has ousted a number of senior European executives over the last year for failing to do better. Now, it’s Girsky’s turn and he has laid out an extensive effort that will include plant closings and job cuts. But because of government rules and union contracts, the plan will take at least until 2014, and perhaps beyond, to fully implement.

That’s a key reason why Adam Jonas, the influential Morgan Stanley automotive analyst recently called on GM to rid itself of Opel.

Girsky and his boss, GM CEO Dan Akerson, insist they are committed to Opel. But a real test of how deep they’re committed will likely be the reception new Opel products receive in a market that has largely written off the German brand. And that effort will begin with the launch of the new Adam, appropriately named as the first of the 23 products under development.

The new model could see broader distribution than just Europe, meanwhile. The Opel Adam will likely see showrooms in a number of key world markets – though production would likely not be based in Europe. There’s even talk of a U.S. version that would be sold by GM’s resurgent Buick brand. But the maker has not yet confirmed that possibility.

For now, Opel will focus on Europe and hope Adam can find its Eve – and perhaps 80,000 more buyers in the coming year.