Despite an intense turnaround effort that will include plant closings, job cuts, a management shake-up – and a flood of new product – General Motors doesn’t expect its hemorrhaging European operations to be back in the black until mid-decade, according to the executive overseeing that rescue effort.

In the near-term, losses are continuing to mount, $478 million for the third quarter, and the maker upping the projected deficit for all of 2012 to somewhere between $1.5 billion and $1.8 billion. GM Europe has consistently run in the red since 1999, total losses now expected to top $17 billion by year-end.

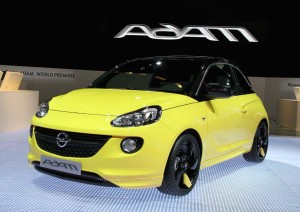

But the picture isn’t entirely bleak. GM’s German-based Opel subsidiary has received strongly positive reviews – and a flurry of orders – for new products such as the compact Mokka crossover and Adam minicar, and GM Europe actually going into the black from a cashflow basis for the July – September quarter.

That was “a positive step in this difficult environment for a company that hasn’t had much positive news” in recent years, suggested Steve Girsky, the former Wall Street automotive analyst who now serves as GM Vice Chairman – and who was put in charge of the European turnaround early this year.

That move came as Karl-Friedrich Stracke was ousted as European CEO – along with a procession of other senior executives. Of 18 top managers a year ago, Girsky estimated “only four or five are left,” replaced by a mix of executives from other European operations, from outside the company and, in a few cases, from the lower ranks at GM Europe.

(GM delivers better Q3 earnings than forecast, despite European problems. Click Here for more.)

There are any number of reasons why the huge and once-powerful operation has collapsed. There is, of course, the current economic crisis crippling the Continent and leading to a serious downturn in overall EU sales. But Opel’s decline began years earlier, in part because “our brand image deteriorated,” Girsky acknowledged during a conference call.

It didn’t help that GM itself made the subsidiary seem like an unwanted stepchild. The Opel brand was nearly sold off in the months after the parent company’s bankruptcy, though Girsky and GM Chairman Dan Akerson, then on the company’s board of directors, helped block that move.

Girsky promises to “bring back” Opel’s image, and that will, first and foremost require the right product. The Opel Adam and Mokka models are just the first in 23 new vehicles and 16 new engines the brand promises to bring to market by 2016.

“We have an aggressive, multi-billion dollar product plan,” asserted Girsky, that will target a number of new segments with models like Mokka. With 40,000 initial orders for the small CUV – GM only able to produce 30,000 of them by year-end – there are preliminary signs the effort is on track.

But there are other significant challenges. Europe has become an extremely high-cost place to produce vehicles, especially Germany, and bringing those costs down is perhaps Girsky’s biggest challenge. One of the most critical steps is to increase factory utilization, Opel’s plants currently operating well below capacity. But closing plants in Europe is extremely difficult, especially in Germany where the powerful union IG Metall has traditionally resisted even modest job cuts.

Nonetheless, GM has plans to close a facility in Antwerp, Belgium and is struggling to win approval from the union and the state government to close another assembly operation in Boccum, Germany. That latter move likely can’t happen before 2014. And even then, many analysts believe it won’t be enough to match demand and capacity. In light of rival Ford’s announcement last week it would close three European plants, Girsky and his new team will feel pressure to cut even deeper — something he hinted is possible.

(For more on Ford’s plans in Europe, Click Here.)

The same is true about overall job cuts. So far this year, GM has cut just 2,300 in Europe, with 300 more to go by the start of 2013. But analysts contend the maker could boost that by an order of magnitude – as it did in the U.S. as the nation plunged into recession in 2008.

GM is, meanwhile, counting heavily on a new alliance it has formed with French automaker PSA Peugeot Citroen. The two plan to jointly develop four new vehicles and will work together on powertrains and a variety of other efforts. But despite promises that each maker’s savings will top $1 billion, observers question the pairing up of two seriously ill manufacturers. Peugeot is expecting a sizable bailout from the French government to keep it afloat.

There are plenty of other steps necessary to right the floundering European ship. Opel is cutting unsold inventory, shifting focus from fleets to more profitable retail customers, and looking for a way to increase the availability of financing for potential customers.

But where the maker once optimistically promised to be back in the black by the end of this year, Girsky is taking a more cautious approach that will take several more years to play out.

“Achieving breakeven results will be a significant milestone,” he concluded.