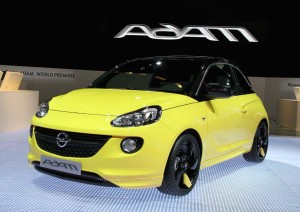

GM's turnaround plan for Opel included new products like the Adam, plant cuts and an expanding alliance with France's Peugeot.

After 14 years of massive losses, General Motors is hoping to turn things around for its German-based Opel brand by closing plants, adding new product – and teaming up with the equally troubled French automaker PSA Peugeot Citroen.

The deal announced by the two makers last February was expected to save each at least a billion dollars by sharing product development, component production and more. And as recently as during the Paris Motor Show, in September, GM and PSA were hinting they saw the opportunity to take things even further.

Now, it appears, GM isn’t quite so sure. The U.S. giant is reportedly putting on hold talks aimed at expanding the alliance, the Reuters news service indicating there’s concern about Peugeot’s commitment in light of the multi-billion-dollar bailout it will now get from the French government.

A GM spokesman confirmed the original alliance is moving ahead, “as planned,” but declined to discuss efforts to expand the partnership.

Alliances have become a way of life in the auto industry, “It’s partner or die,” contends David Cole, director-emeritus of the Center for Automotive Research, in Ann Arbor, Michigan.

In many ways, Opel and Peugeot seemed to be taking their cues from the well-regarded three-way alliance between the other French automaker, Renault, Japan’s Nissan and Germany’s Daimler AG, the maker of Smart and Mercedes-Benz products. They also announced some major new projects during the Paris Motor Show. Among other things, Renault will help develop new products for the Smart brand, Nissan will provide engines for Mercedes products assembled in the U.S. and the German maker will provide a small platform for Nissan’s Infiniti brand.

The initial plans for Opel and Peugeot include the development of four separate products – though the underlying platform could eventually be used for additional models. They also are forming a global purchasing joint venture for sourcing of parts and services that could amount to a combined $125 billion annually.

Joint manufacturing also appeared to be in the works as a way to help both Opel and Peugeot better utilize factory networks currently operating well below capacity.

As part of its effort to turnaround program, Opel has already confirmed it will close a plant in Antwerp and it also hopes to close at least one more facility in Germany if it can win union and government approval.

PSA Peugeot Citroen has also challenged the status quo by announcing plans to close one of its French plants – news that set off a wave of protest and a threatened challenge by the country’s new Socialist government.

But rather than a stick, Peugeot has been offered a carrot in the form of a financial bailout package. And there is a growing likelihood it will delay or scrub plans for that plant closure. According to Reuters, an unnamed source accused the French government of “sabotaging the plans” for the alliance with GM since the French maker likely won’t press to trim capacity and improve productivity at the pace originally envisioned.

‘Now, it appears, GM isn’t quite so sure. The U.S. giant is reportedly putting on hold talks aimed at expanding the alliance, the Reuters news service indicating there’s concern about Peugeot’s commitment in light of the multi-billion-dollar bailout it will now get from the French government.”

Peugeot put all hopes on the 15 years OLD BMW’s Valvetronic ‘innovation”

It worked for BMW, it didn’t for Peugeot, leaving it (Peugeot) naked.

http://www.pattakon.com/pattakonDesmo.htm

http://www.pattakon.com/pattakonRodRoller.htm

http://www.pattakon.com/pattakonRoller.htm

manousos.pattakos@pattakon.com