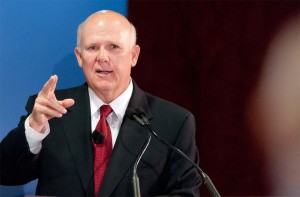

With the U.S. Treasury getting set to sell off its remaining stake in General Motors over the next year, the Detroit maker is looking ahead to a time when it can not only regain its complete independence but also win over skeptical investors, analysts and consumers, GM CEO Dan Akerson said during a rare meeting with journalists.

Akerson said he is confident GM can achieve a “modest share increase” in the U.S. this year after a weak performance in 2012 that saw is share slip to an 80-year low of just 17.9%. But he also admitted the situation in Europe, where GM has now operated in the red for 14 straight years, is still a challenge.

One of the executive’s ongoing goals is driving up profitability which Akerson hopes, will also help prop up GM’s share price. While the maker has made significant gains in recent months, its shares are still trading about 10% below the $33 strike price set during the November 2010 GM IPO.

The other challenge facing GM is digging its way out of “junk” territory, where its debt rating has lingered since 2005 – though in a positive sign, a recently negotiated line of credit was able to generate an investment grade raing.

Suggesting it “starts and ends with product,” the former telecomm executive told reporters he is looking forward to a substantial boost from the various products GM will introduce in the U.S. this coming year. That includes some significant offerings set to make their first public appearance at the North American International Auto Show this month.

That includes the Chevrolet Corvette “C7,” a halo car that many expect to be one of the stars of the Detroit Auto Show, as well as two critical truck products, the full-size Chevy Silverado and GMC Sierra pickups. Mark Reuss, president of GM’s North American operations underscored the significance of the trucks when he suggested “nothing is more core to our business” during a media preview last month.

GM sales rose 3.7% last year, barely a quarter of the market’s overall gain, despite the launch of a number of well-touted models, such as the Cadillac ATS and Chevrolet Malibu. As a result, its share slipped to an eight-decade low as key competitors nudged out even larger sales gains.

Whether the Detroit maker can improve things in 2013 is a matter of debate, though a new survey of senior auto industry executives by consulting firm KPMG is somewhat bullish. Though GM is not among the top 10 brands projected to gain share in the coming years, a growing number of automotive leaders due expect a turnaround.

“Executive confidence behind GM saw a boost in the 2013 KPMG survey, with 44% predicting market share gains in the next five years, up from 40% in 2011, and just 13% in 2010,” noted a release from the consulting firm. “Investments in new products and production innovation,” said Gary Silberg, KPMG’s national automotive industry leader, “clearly…have helped.”

While Akerson fretted that the situation in Europe could continue to get worse, he predicted another big jump in U.S. sales, from 2012’s 14.5 million to anywhere between 15.0 million and 15.5 million for 2013.

In December, GM was forced to sharply ramp up incentives on the outgoing Silverado and Sierra pickups, but Akerson stressed his company’s goal is to no longer be at the high end of the industry when it comes to rebates and other givebacks. “We want to be in the middle,” he said, adding that, “Our prices are up, we’re able to command premium pricing and in some of the segments we are the leader.

An industry outsider until he was asked by the Obama Administration to join the GM board following its 2009 bankruptcy, the 64-year-old Akerson does not appear to be in a rush to leave the company.

“I think I’ll be here next year at this time,” he told reporters assembled at the GM Renaissance Center headquarters in Detroit.