General Motors earnings took a sharp downturn in 2012, falling to $4.9 billion, or $2.92 a share, compared to $7.6 billion, or $4.58 a share, the year before. The maker blamed “unfavorable” special items, but the decline also reflected GM’s ongoing struggles to reverse 13 years of red ink from its floundering European operations.

The largest of the U.S. automakers said fourth-quarter net income came to $0.9 billion, an increase from the $500 million it reported during the October to December period in 2011, per-share results rising to 48-cents, a 9-cent year-over-year increase.

Nonetheless, the fourth-quarter numbers fell short of the 51-cent consensus estimate from Thomson Reuters, triggering a negative response from investors during early trading.

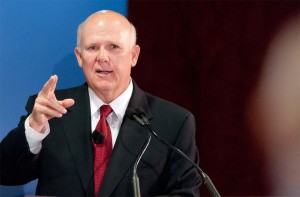

Despite that tepid reaction, GM officials were upbeat. “We recorded another solid year in 2012 as we grew the business, delivered a third straight year of profitability and took significant actions to put the company on a solid path for future growth,” said Dan Akerson, chairman and CEO.

GM’s U.S. hourly workers could have a more positive response than Wall Street, meanwhile, the maker announcing it will pay out $6,750 in profit-sharing checks to 49,000 eligible members of the United Auto Workers union.

Looking forward, Akerson said that, “This year our priorities will be executing flawless new vehicle launches, controlling costs and delivering more vehicles to our customers at outstanding value.”

The New Year could prove a critical one for GM – and for Akerson’s legacy. The giant maker clearly had some challenges in 2012. Despite adding a number of new vehicles, such as the 2013 Chevrolet Malibu, sales fell short of expectations – unable to keep pace with the U.S. market’s overall 13.5% upturn – and market share slipped by 1.5 points to 16.9%.

But the maker’s biggest setback came in Europe, where it once again failed to stem a serious slide that has been dragging down its balance sheet for 13 years. On an Earnings-Before-Interest-and-Taxes, or EBIT-adjusted basis, GM lost $1.8 billion on the Continent last year and $700 million for the final quarter. That compared with a $700 million loss for all of 2011.

Akerson’s top lieutenant, Vice Chairman Steve Girsky, announced a number of critical steps in recent months – including plant closings and substantial job cuts – that the company hopes will begin to show results in 2013.

The fourth-quarter GM numbers bear the hit of a number of special, one-time items, including a $5.2 billion non-cash impairment of GM Europe’s assets, and a $2.2 billion charge related to changes in the company’s U.S. salaried pension plan.

In North America, GM reported fourth-quarter EBIT-adjusted earnings slid to $1.4 billion from the year-earlier results of $1.5 billion. For the full year, the core operations saw earnings dip by $200 million, to $7.0 billion.

There were a few bright spots for the maker, which slipped to second place in global sales during 2012, passed up by Toyota Motor Co.

In South America, the EBIT rose to $0.1 billion during the fourth quarter, up from a $0.2 billion loss the year before. For the full year, the earnings jumped to $0.3 billion, compared to a $0.1 billion loss in 2011.

GM International Operations, which cover the rest of the world, including China, saw EBIT income rise to $0.5 billion for the final quarter, compared with $0.4 billion, while the full-year number was $2.2 billion, compared to the 2011 EBIT of $1.9 billion.

Notably, GM set another all-time sales record for the Chinese market in 2012, and with China’s economy showing signs of improvement as 2013 gets underway, the pace of sales is already rising.

Looking ahead, GM will have a number of critical launches this year, including all-new versions of its traditionally high-profit full-size pickups, the Chevrolet Silverado and GMC Sierra. It will get back into the U.S. diesel passenger car market for the first time since 1996 with the Chevy Cruze Diesel, and it will continue the “renaissance” of its flagship Cadillac brand which is also planning to start producing vehicles in China.

But the maker can only hope that the turnaround plan envisioned by V. Chairman Girsky’s team can finally take hold in Europe, a challenge that could get even tougher with signs that the Continent’s economic powerhouse, Germany, is beginning to falter.