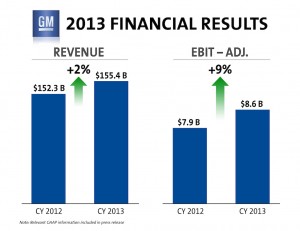

General Motors Co. (NYSE: GM) today reported 2013 calendar-year net income of $3.8 billion, or $2.38 per fully-diluted share.

While its revenue for the quarter and the year rose, General Motors reported its fourth-quarter earnings were flat and full-year earnings were down on a year-over-year basis due to special charges related to some of the company’s restructuring actions.

However, the company’s positive performance in North America buoyed its quarter and year and resulted in its eligible hourly employees expected to received profit sharing checks up to $7,500 each.

“Launches of some of the best vehicles in our history combined with significant improvements in our core business led to a solid year,” said GM CEO Mary Barra. “The tough decisions made during the year will further strengthen our operations. We’re now in execution mode and our sole focus will be on delivering results on a global basis.”

The maker reported earnings of $900 million, or 57 cents per share, on revenue of $40.5 billion for the fourth quarter of 2013. In 2012, the company reported earnings of $900 million revenue of $39.3 billion.

The company took $1.2 billion in financial hits related to the exit of Chevrolet from Europe as well as the shuttering of its operations in Australia; however, a favorable tax settlement and a gain on the sale of an equity investment in Ally Financial, along with other smaller items, partially offset these charges to a net loss on the charges of approximately $200 million.

Earnings adjusted for interest and taxes were $1.9 billion in the fourth quarter of 2013, compared with $1.2 billion in the fourth quarter of 2012.

GM’s North America operations (GMNA) generated much of the positive cash flow for the company in both the fourth quarter as well as the entire year. GMNA reported EBIT-adjusted of $1.9 billion in the fourth quarter of 2013 compared with $1.1 billion in 2012.

For the full-year EBIT-adjusted was $7.5 billion in 2013 compared to $6.5 billion in 2012, setting a record for earnings in North America. Based on GMNA’s 2013 financial performance, the company will pay profit sharing of up to $7,500 to approximately 48,500 eligible GM U.S. hourly employees.

(GM joint venture making $50 million bet on Ohio diesel plant. For more, Click Here.)

For the full year, GM’s earnings were down compared to 2012. In 2013, calendar-year net income was $3.8 billion, or $2.38 per fully diluted share, down from $4.9 billion, or $2.92 per fully diluted share in 2012. GM said its operating performance improved during the year, but was more than offset by a net loss from special items and incremental tax expense.

GM retained its strong cash position at the end 2013 with strong total automotive liquidity of $38.3 billion compared with $37.2 billion at year-end in 2012. Automotive cash and marketable securities was $27.9 billion at the end of 2013, compared with $26.1 billion a year earlier. GM expects capital expenditures for 2014 to be approximately $7.5 billion.

(Click Here to read about Mazda, Lexus kudos for lowest cost of ownership.)

While the company was profitable, the drop concerned some investors and the stock is down about 3% in premarket activities. However, analysts expect the introduction of new products to allay any long-term concerns about the maker.

“GM seems to have stabilized in the past 12 months, not just in the U.S. but globally. Transaction prices, sales and market share all indicate moderate growth except in Europe, where ongoing losses also appear to be stabilizing,” said Karl Brauer, senior analyst, Kelley Blue Book.

(To see GM’s Q3 earnings results, Click Here.)

“The automaker’s fourth quarter performance reflects its steady growth, which looks to continue in 2014. GM wants to maintain transaction prices and profitability going forward, which means limiting incentive spending. This is a worthy goal, though it gives competitors an opportunity to capture sales and market share, something we saw with the all new Silverado in the fourth quarter and something GM will have to balance carefully going forward.”