Calling it “potentially precedent-setting,” a Seattle law firm has filed a class-action lawsuit against General Motors that could, it estimated, expose the automaker to damages of as much as $10 billion for economic losses suffered by owners of GM products.

At the heart of the case, the consumers-rights firm Hagens Berman Sobol Shapiro argues that owners of products such as the Chevrolet Cobalt sedan and sporty Chevy Camaro coupe not only paid more than they should have, but will get back less in trade-in, than they deserve as a result of the troubled Detroit automaker’s rapidly expanding list of safety-related recalls, which has grown to nearly 18 million vehicles this year alone.

The suit was filed on the same day GM CEO Mary Barra returned to Capitol Hill for hearings on the maker’s problems, in particular, the decade-long delay in recalling vehicles equipped with a faulty ignition switch linked to at least 13 deaths. GM also faces an investigation by the Justice Department that could lead to criminal charges and huge fines.

(For more on Barra’s return trip to Washington, Click Here.)

But despite the breadth of its recall problems, and sometimes breathless headlines that has engendered, the new class-action lawsuit appears, at best, to rest on shaky data and emotional appeal. If anything, the numbers generally suggest that the maker’s ongoing recall problems have had little, if any impact on the sale of either its new or used vehicles, nor on the prices consumers have been willing to pay.

“GM came out of bankruptcy making claims that the company would produce high-quality, safe vehicles, a branding position that served GM well, and that consumers relied upon,” said Steve Berman, managing partner of Hagens Berman. In a prepared statement, he added that, “Now we know that contrary to those claims, GM was instead wallowing in a dysfunctional culture more concerned about hiding defects and safety flaws than living up to its purported brand promise.”

(GM has more product segment winners than any other maker in new JD Power Initial Quality Study. Click Here for more.)

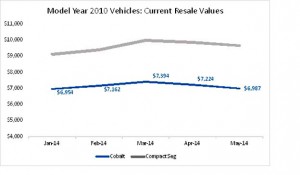

A chart showing Chevy Cobalt residual values tracking in line with the rest of the compact segment. Chart and data courtesy: TrueCar.com and ALG.

Despite repeated promises to make the managing partner available for an interview, Berman could not be reached to discuss the suit. In a news release, the firm estimated that a “forensic” examination showed that the value of “GM-branded vehicles” decreased “from $500 to more than $2600 per vehicle and may go higher on some vehicles.”

In fact, there are no GM-branded products. Prior to the maker’s bankruptcy, it sold vehicles under eight different brands, half of which vanished following its July 2009 emergence from Chapter 11. Despite that sort of legalese nit-picking, the question is whether GM vehicles actually have lost significant value on the used car market.

The simple answer is, “no,” according to three of the firms that most closely track trade-in prices – or, in industry terms, “residual values,” Kelley Blue Book, the Black Book, and ALG, formerly known as the Automotive Leasing Guide.

The vehicles likely to have shown the biggest impact would have been the 2.6 million covered by GM’s original ignition switch problem, first announced in February. In fact, Black Book data shows that a 6-year-old Chevrolet Cobalt increased $150 in value between March and May of this year compared with the same three-month period in 2013.

“As far as any impact on value, we haven’t seen it,” said Black Book Editor Ricky Beggs. There has been, “no effect on residuals from these recalls whatsoever.”

Kelley, or KBB, also saw an increase. While some prices have dipped slightly, according to ALG, the dip is minimal, and “short-term” and, perhaps more important, absolutely in line with the normal shifts in value of products from competing brands.

“Residuals are slipping because there’s more of a supply” of nearly-new vehicles now that the new car market is recovering, stressed Scott Painter, chairman of ALG and CEO of its parent company, TrueCar.com.

In his firm’s lawsuit, lawyer Berman also claimed that motorists paid more for new GM vehicles had they “known that the manufacturer had gone to such great lengths to hide safety defects.”

(Internal study finds “pattern of incompetence and neglect” led to GM’s recall woes. Click Here for the full story.)

It’s difficult to impossible to know what the hypothetical buyer of a 2010 Chevy Camaro might have done had all of GM’s safety problems been revealed four years ago. But it is possible to look at what is happening today. And, if anything, the numbers again work in the automaker’s favor. GM’s sales, for one thing, rose 12.6% for the first five months of 2014 – ahead of the industry average gain of 11.5%.

Kelley Blue Book reports that GM’s average transaction prices – what the typical consumer paid after calculating in discounts and options — rose to $34,783 in May, second-highest among mainstream makers, from $33,955 a year earlier. Meanwhile the incentives normally used to lure in reluctant buyers, have declined, though GM continues to offer some of the industry’s largest givebacks – as it has for years.

In the Hagens Berman news release, attorney Berman concludes, “GM’s egregious and widely publicized conduct, including the seemingly never-ending and piecemeal nature of GM’s recalls, has so tarnished the affected vehicles that no reasonable consumer would purchase them for what would otherwise be fair market value for the vehicles.”

While it is hard to dispute that GM has tarnished its corporate image, it’s far less apparent that this has translated into any measurable financial loss for owners. If anything, GM cars appear to be commanding strong prices, new or used.

For its part, GM officials declined to comment on the lawsuit. TrueCar’s Scott Painter was far less circumspect. He declared the suit, ““opportunistic and despicable,” concluding it is “absolutely without validation and scientific merit.”

This is PRECISELY what I expected from the siren chasers. They want to obtain windfall legal fees from an incident involving 13 accidents – some of which have nothing to do with the ignition switch at all.

Unscrupulous U.S. lawyers have corrupted the judicial system for profit. They believe in Jackpot Justice and you can be sure that a braindead jury will assist them in stealing BILLIONS from GM in this case. It’s the “American Way” when it comes to criminal behavior by bottom feeders.

All of the liars filing suits and media-hyped hysteria notwithstanding, the market has spoken.

At the end of the day, their claims are baseless.

Fact is, at least half the folks driving a Chevy, Buick or Cadillac even realize it is a GM product. Probably due to 100+ years of brand building, or, plain old consumer inattention, or more likely, both. For the people who do know; who cares? The car has been repaired in the recall before resale, or will be. This is only an issue for the unfortunate families of the young people killed. They are entirely ignored in this carnival side-show.

I think it’s way to early to get the true story. Many of the public hasn’t even heard about the issues with the GM recalls and deaths that occurred. I’m very interested in automotive industry news, and I just heard of it recently. I have noticed that although the resale value of the cars hasn’t changed since the first part of the year they are going down since the news is getting out. I would expect to see a decline in the value of the cars as more of the public hears about the recalls and deaths. I certainly will not be looking at GM cars for some time.

Hi, Hal,

I have to disagree on almost all counts. The GM recalls have been headlines in every possible medium and media, including non-traditional “news” sources like the Daily Show, never mind the late night talk shows and even Bill Maher’s program on HBO. The awareness of the problems, at least at a marginal level, is probably greater than for any other safety-related issue ever, including the dragged out recalls at Toyota in 2009 and 2010. (Did those affect your position on Toyota, long-term, by the way?) The data do not support your point that resale values have dropped — certainly nothing out of line with the overall residuals that various GM models compete in. In some cases, the numbers actually have gone up. So have GM sales overall, both retail and fleet, along with average transaction prices. Incentives have generally slipped. Yes, things could change but based on historical patterns, we should already have been seeing a major impact by now. Let’s see how trends shake out the rest of the year.

Paul A. Eisenstein

Publisher, TheDetroitBureau.com