Buyers anxiously awaiting the arrival of the new Chevrolet Colorado can use the maker's "Build Your Own" online tool to price out a new one.

Potential buyers anxiously awaiting the arrival of the new Chevrolet Colorado, the brand’s new midsize pickup, have a reason to rush to their nearest computer: they can build their own.

The maker is introducing its “Build Your Own” online tool for buyers who want to sift through the various options available on the new truck. The tool will be made available for its sibling, the GMC Canyon, in the coming weeks.

“Our truck lineup is all about giving truck buyers choice,” said Tony Johnson, Colorado marketing manager. “With the Build Your Own site, Colorado customers can equip their truck, request a quote from the dealer and even get a price on their trade-in.”

While the maker is letting future buyers know they can start making choices on their truck of their choosing now, even before the tool went live on the Internet, dealers around the country were already lining up to place their orders for the new trucks.

Many believe the trucks will revitalize a segment that not too long ago outsold full-size pickups, but now barely registers as a blip on the sales radar. Pricing on full-size trucks dropped, particularly for leases, and they began to put the squeeze on their smaller counterparts.

However, as gas prices took off and the economy continues to recover slowly, midsize trucks and their fuel economy advantages and improved performance are regaining favor with truck buyers.

GM’s trucks are staking out that ground in the fight for sales. The automaker claims that they are the class leaders in fuel economy. For V-6 pickups with automatic transmissions, which make up the majority of midsize truck sales, Colorado and Canyon offer highway fuel economy 3 to 5 mpg better than competitors, GM says.

As diesels gain favor with the public, GM is going to offer that option as well. For the 2016 model year, Colorado and Canyon will add a 2.8-liter Duramax turbodiesel to the engine lineup.

Whether or not the trucks regain the sales they once enjoyed remains to be seen, but the segment has piqued the interest of competitors. Chrysler plans to re-enter the segment and foreign makers, such as Toyota and Nissan, are redesigning they’re smaller trucks to keep pace. Ford is staunchly maintaining it will not enter the midsize truck market despite have a midsize Ranger for markets outside the U.S.

There are several who continue to consider their options, including both of the Korean carmakers, Hyundai and Kia. But the makers most likely to take some action could be Detroit-based Jeep, and German giant Volkswagen AG — which already has an option available, the midsize Amarok pickup it sells in a wide range of overseas markets.

Just last November, then Volkswagen Group of America CEO Jonathan Browning said he’d like to start importing the Amarok – if the U.S. government would just kill off its half-century-old “Chicken Tax,” a retaliatory tariff that morphed into a 25% penalty on imported trucks.

Browning is no longer the head of VWGoA, but his successor, it seems, continues to talk truck.

(VW, Jeep consider options for pickup truck in U.S. For more, Click Here.)

“It’s a question mark, but it starts to be discussed. Let’s put it this way: we start to discuss it again and whether it’s attractive for us,” Michael Horn told Autoblog.com.

The question is what pickup would work for the truck-crazy U.S. market. Horn told Autoblog he thinks the Amarok “is too small,” reflecting the widespread concern that American buyers still go by the mantra “bigger is better.”

For his part, Heinz-Jakob Neußer, head of VW Group’s powertrain development operations revealed during a Geneva Motor Show roundtable that, “We are just reworking our truck strategy, and this is part of thinking about it. But the Amarok fits not very well to the efforts of the market.”

(Click Here for details on the Colorado and Canyon.)

Like Volkswagen, the Jeep brand is looking for ways to make a business case. The U.S. maker does have the advantage, however, of domestic production, which would not subject a Jeep pickup to the chicken tax,

(That penalty was so named because it originally arose as a tit-for-tat U.S. tariff after Europe enacted penalties on imports of American-raised poultry. Today, curiously, the 25% duty on imported trucks is all that remains.)

Fiat Chrysler Automobiles officials aren’t discussing their plans on the record, but several have confirmed privately that there is an active development effort targeting Jeep rather than the Ram brand that recently dropped its Dakota line.

(To see TDB’s first drive in the BMW M3 and M4, Click Here.)

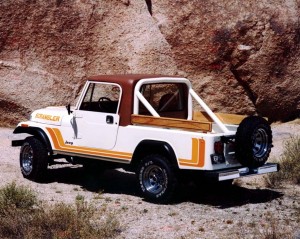

That might seem odd until you recognize Jeep has a history of building pickups dating back to the Forward Control of founder Willys, and the later J10 and J20 models assembled under the ownership of Kaiser.

More recently, the Wrangler-based Scrambler, and the Cherokee-based Comanche were produced through the 1980s and, for the Comanche, into the early ’90s. A number of Jeep concept vehicles have followed over the years, most recently the Mighty FC and Gladiator show cars.

The latest Jeep pickup project is far from production and coming up with the right business case remains as big a challenge as finding the right design. But the surge in the full-size truck market has buoyed hopes – and if the new Chevy Colorado and GM Canyon midsize models score well in the U.S. market, said a senior insider, it would clearly help boost Jeep’s desires to get back in the pickup game.

How is this statement vaguely true “GM Continues Push Leadership in Midsize Truck Segment”

They aren’t and won’t be anywhere near the leader. Toyota OWNS this segment. Good Luck GM, you thought you had a tough time cracking into the small car segments, this will be interesting….

That Colorado looks to be the same size as an early 90s 1500.

That is the irony. Today’s full-size trucks are about as big as old heavies, and compacts are not the size of an old half-ton.

Paul E.