Crediting improved sales, cost-cutting and a weak yen, Nissan is reporting a 21% jump in its quarterly profits, while also increasing its earnings estimate for the full fiscal year.

The second-largest of the Japanese makers earned 101.8 billion yen for the October to December quarter, or $856 million. That was significantly better than the 83 billion yen, or 697 million consensus forecast, according to FactSet.

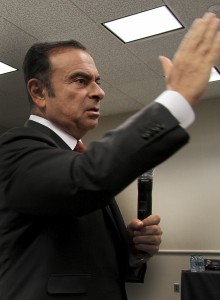

“Nissan delivered solid financial results in the first nine months of the fiscal year, reflecting rising U.S. sales of our latest models and a normalizing yen-dollar exchange rate,” said the maker’s President and CEO Carlos Ghosn, in a statement.

Crediting “positive momentum” in sales, as well as a weak yen, Ghosn upped the full-year forecast for Nissan to 420 billion yen, or $3.5 billion, which would be an 8% annual increase. Nissan had originally expected to earn 405 billion yen, or $3.4 billion, for the fiscal year which ends on March 31.

For the quarter, Nissan sales jumped 17%, to 2.94 trillion yen, or $24.7 billion – also ahead of analysts’ forecasts. Nissan now expects sales for the full year to climb from 10.8 trillion yen to 11.15 trillion, or $93.7 billion.

(Nissan slips new Maxima into Super Bowl ad. Click Herefor a closer look.)

A variety of factors played out for Nissan which is in the middle of its so-called Power 88 plan, which calls for a global market share of 8%, and margins of 8%. For the latest quarter, operating margins fell short of that target, at 5.2%.

Sales have been particularly strong in North America and Western Europe which, Ghosn noted, “offsets volatility in other markets.” Like key rival Toyota, Nissan has been struggling in China. And the home Japanese market has been in a slump since new sales taxes were put in place last year.

Several products have been key to the maker’s performance in recent months, including the midsize Altima sedan. Nissan also produces the world’s best-selling battery-electric vehicle, the Leaf, though plug-based vehicle sales still account for less than 0.5% of the global automotive market.

(Nissan ready for return to LM P1 Le Mans endurance racing circuit. Click Here to find out more.)

The weak yen has helped all of the Japanese makers, though it still didn’t provide enough momentum to help Honda which reported a 15% decline in earnings for the October to December quarter. The third-largest Japanese maker was hammered by the cost of recalling millions of vehicles equipped with potentially faulty Takata airbags.

Toyota, on the other hand, saw a 14% jump in third-quarter earnings while also raising its full-year forecast. Toyota maintained its position as the world’s largest automaker in calendar 2014, with sales topping 10 million vehicles, a major industry milestone. By comparison, Nissan sales ran about half that volume. But the maker is part of a global alliance with France’s Renault and, together, the partners are generating sales volume of around 8.5 million vehicles.

Nissan also has joined in a less extensive alliance with Germany’s Daimler AG. Among other things, a Mercedes platform will be used as the foundation of a new line of small luxury products from the Japanese Infiniti brand.

Both of these partnerships have been critical, Ghosn has said, to maintaining competitive economies of scale.

(Infiniti offers sneak peek at new QX30 crossover to debut at Geneva Motor Show. Click Here to check it out.)