Conventional wisdom is taking another beating as a new study indicates that getting a ticket actually doesn’t boost a driver’s insurance rates.

Only 19% of Americans who received a traffic ticket in the past five years are paying more for car insurance as a result, according to a report from insuranceQuotes.com released today. This is a decrease from 2013 when 31% of Americans who received a recent traffic ticket saw an increase in their car insurance premium.

While fewer folks are seeing insurance rates rise, there are some violations that will cause a significant leap in what you pay. The website found that offenses such as driving under the influence of drugs or alcohol, reckless driving and leaving the scene of an accident almost always result in higher premiums – as much as 92% higher.

Sometimes, a carrier will even drop the offending driver’s coverage entirely. People who commit several smaller violations are also more likely to face higher car insurance costs.

The study also found that while Millennials or young drivers between 16 and 30 may be considered the motorists most likely to engage in risky driving, it’s actually Americans between the ages of 30 and 49 who are the country’s most ticketed drivers.

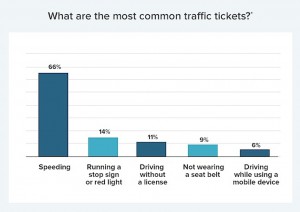

While that segment is the most ticketed, the most likely group to get a speeding ticket isn’t the group most would pick – young drivers – but instead is 50-64 year olds getting the highest number of speeding tickets. Speeding is also the most common violation at 66% of tickets issued.

(Maine is the cheapest state for auto insurance. For more, Click Here.)

However, older drivers seem to be getting a break when they get those tickets. Drivers 18-49 years old are three times more likely to see their insurance premiums rise after receiving a ticket than drivers 50-64 years old, according to insuranceQuotes.com.

If you’ve been ticketed, but your insurance hasn’t gone up, here are the top five reasons why:

- It was a minor violation: Not all violations are created equal and not all tickets appear on a driver’s record.

- A good driving history: The insurance company treats it as an anomaly because you have a stellar record.

- Incident forgiveness: More insurers offer incident forgiveness, which waives surcharges for an accident or ticket.

- Insurer didn’t check your record: It’s becoming more common for insurers to not check the records of current policyholders due to the costs involved.

- The ticket was waived: The driver took it to court and got the violation waived or removed from their record by attending traffic school.

Laura Adams, insuranceQuotes.com senior analyst, noted that the typical insurance carrier will check a young driver’s record every six months, but won’t regularly check an older driver’s as these checks can be costly – and older drivers typically are safer drivers.

(Click Here for details about why the Jeep Wrangler is the cheapest vehicle to insure.)

High-income Americans, which is households with annual income of $75,000 or more, were the most likely of all income brackets to have received a ticket in the last five years.

(To see what can cause your insurance to jump as much as 76%, Click Here.)

Adams suggested motors can use different tactics to help mitigate the impact of a ticket such as taking a class at traffic safety school. In most states, drivers who complete the class can wipe points off your driving record and learn how to improve your driving skills, she said.

Also make sure you update your vehicle registration, license plates and state inspection. Letting one of these expire can draw extra attention from law enforcement. Avoiding additional tickets to reduce the risk of increasing your insurance premium.

The worthless “safety classes” that people attend to have a ticket ignored are a waste of time. It’s all about the revenue. The classes are just a revenue game as are a lot of speeding tickets. I’m all for obeying speed limits and other vehicular laws but I don’t believe in the bogus revenue schemes used by many municipalities.

If I were a cop I could easily issue hundreds of tickets daily for speeders and dangerous drivers. IME it’s getting more dangerous on the roadways daily between the distracted driving, drug use and vehicle operators who simply do not care – as if they have a death wish.