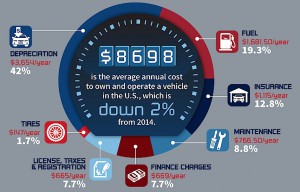

If you’ve gotten used to the idea that you’ll always be paying more – for housing, food, clothing – you may be in for a pleasant surprise when it comes to driving, as you can expect to pay about 2% less to operate your car this year.

Credit lower fuel costs and cut-rate car loans, according to the AAA’s annual “Your Driving Costs” study. Unfortunately, the survey also found that some other automotive expenses are expected to rise this year, notably including auto insurance, maintenance and tires. And if you’re planning to buy this year, AAA cautions that you’ll likely be getting less for that trade-in, which translates into higher depreciation costs.

Nontheless, “Car owners can look forward to saving approximately $178 this year,” explained John Nielsen, AAA’s managing director of Automotive Engineering and Repair, and the savings will be even greater for those driving large, fuel-hungry vehicles such as minivans, pickups and SUVs, the AAA reported.

The study was based on what it costs to operate the typical vehicle, clocking 15,000 miles a year. The AAA figures it will cost 58 cents a mile, or about $725 a month.

That’s for the “average” sedan. For a small sedan, the cost drops to 44.9 cents per mile or $6,729 annually. A large sedan will cost its owner 71 cents per mile or $10,649 for all of 2015. A minivan costs 62.5 cents a mile or $9,372 annually, while an all-wheel-drive SUV jumps to 70.8 cents a mile, or $10,624 for the full year.

Of course, as the cliché goes, “results may vary,” depending on the specific model, as well as how and where your drive. As TheDetroitBureau.com recently reported, a motorist in Michigan might pay twice as much as one living in Maine for car insurance. A New Jersey driver will pay substantially less than someone living in California for fuel.

But, on average, AAA expects that for all of 2015 fuel costs should be about 13.77% less than what U.S. motorists were paying at the pump last year, at 11.2 cents per mile. That works out to a savings of $268.50, or $1,681.50 for all of 2015.

Finance charges took an even bigger dip, the organization found, dipping 21.02%, to $669 annually, a savings of $178. Again, that’s an average that could vary widely depending on a buyer’s credit score, and what lender they use.

Now, here comes the bad news. Depreciation will increase $144, or 4.1%, AAA forecast. The steady decline in the value of your car, truck or crossover makes up the largest single share of the annual ownership cost, about 42%, or $3,654.

(Motorists watch fuel costs steadily climb upward. For more, Click Here.)

And it can slide up or down depending on the state of the used car market. In recent years, a shortage of high-quality “previously owned” vehicles made it a seller’s market. Now there’s a glut and buyers are in the driver’s seat.

On a percentage basis, the biggest increase comes in the insurance category. The AAA anticipates an 8.99%, or $92, increase this year. The average motorist will spend $1,115 for an auto policy in 2015.

(Click Here for details about American’s new love affair with small SUVs.)

Other increases include license, registration and taxes, forecast to jump 3.74%, or $24, to $665. Maintenance is expected to rise .99%, or $7.50, to $766.50. And tires are looking to roll up a 1.03%, or $1.50 increase, at $147 for 2015.

Longer term, the AAA survey could raise concerns. Fuel prices have already begun to rebound after dipping below $2 a gallon in much of the country early this year. How much further prices could increase – and how quickly – is far from certain, but most forecasts call for an upward trend.

(To see more about April’s strong auto sales results, Click Here.)

Meanwhile, the Federal Reserve is expected to increase interest rates as the nation’s economic recovery continues. Those two factors alone could translate into higher operating costs in 2016 and beyond.

I haven’t seen any drop in insurance rates or taxes and I doubt the majority of drivers have. The shot term drop in fuel prices will be just a memory soon.