Keep on trucking. Vehicles like the new Renegade helped Jeep score some of the industry's biggest gains in August.

Despite Wall Street’s shake-up, China’s sliding economy – and a fluke of the calendar – the U.S. auto industry did a bit better than anticipated in August, with far less of a downturn than some had predicted and a number of manufacturers managing to eke out strong gains.

While some brands, such as Toyota, saw sharp declines, others pushed into record sales numbers. And carnakers continued to see average transaction prices rise again last month, prices running at or near record levels for most of them, according to industry analysts.

“In spite of a tough 2014 comparison and extreme stock market volatility, our dealer’s competitive spirit kicked in and propelled us to our 65th-consecutive month of year-over-year sales increases,” said Reid Bigland, Head of U.S. Sales. “Our Jeep brand turned in a double-digit increase while eight individual models, including four Jeep brand vehicles, set sales records.”

Audi scored its 56th straight monthly record, its sales rising by 9.9% in the U.S. While Mazda didn’t fare as well overall, the Japanese maker did mark an all-time record with the recently launched, fourth-generation version of its two-seat Miata Roadster.

(Quality issues, high prices start to frustrate U.S. buyers, warns new study. Click Here for more.)

Demand for the efficient Ford EcoBoost engines shows shoppers haven't entirely abandoned fuel economy.

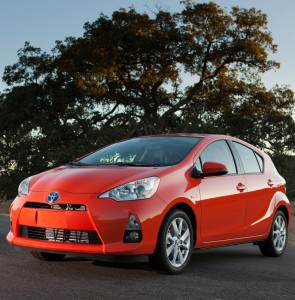

Toyota, which has been struggling to maintain global sales leadership, had one of the sharper declines in U.S. demand last month, its volume down 8.8% year-over-year. But the maker noted that the downturn was a more modest 5.3% on a daily selling basis. The late timing of the Labor Day holiday this year was expected to make for some bad year-over-year comparisons, as many buyers were expected to hold off shopping to take advantage of the usual holiday sales.

Nissan noted that it was down 1% overall for August, but had a modest 3% increase on a daily selling basis.

General Motors also put a positive spin on its 0.7% decline for August, continuing a recent series of monthly declines. The Detroit giant has emphasized that it is cutting back on fleet sales, especially to low-profit rental fleets, which were off 24% year-over-year in August.

Focusing on retail business alone, said Kurt McNeil, the maker’s vice president of sales, GM reported a 6% increase for the month which “far outpaced the industry.” GM is looking to do even better with the upcoming launches of key products including the redesigned Chevrolet Cruze and Malibu models.

Detroit makers, in general, have benefiting from the drop in gas prices and concurrent increase in demand for crossovers, SUVs and pickups. The Jeep brand, for example, was up 18%, helping fuel Fiat Chrysler’s overall 2% gain for the month.

Ford Motor Company delivered its best August U.S. sales in nine years, a 5% increase, said Mark LaNeve, Ford vice president, U.S. Marketing, Sales and Service.

“Improved availability helped make August the strongest sales month this year for F-Series,” the full-size pickup that went through a major – if controversial – redesign for 2015, noted LaNeve. “We also had our best month of Ford SUV sales in 12 years.”

(Ford building momentum for F-150 after slow start. Click Here for the story.)

While U.S. buyers have been shifting away from small cars, hybrids and other green vehicles in recent months, they haven’t entirely lost focus on fuel economy. Demand for Ford’s higher-mileage EcoBoost engines has continued to grow. That was especially notable last month in the F-Series line-up. Those downsized, turbocharged engines powered 63% of the full-sized trucks Ford sold last month, V-8 versions continuing to lose momentum in the marketplace.

But the success of the EcoBoost didn’t extend to other, more advanced powertrain technologies. The electric vehicle segment “continues to dip in sales as well as average transaction prices, down nearly 3% from just last month,” said Kelley Blue Book analyst Akshay Anand.

(Toyota to launch all-new Prius next week. Click Herefor a preview.)

That was a rare exception when it comes to pricing, however. KBB report the estimated average transaction price for all light vehicles in the United States was $33,543 in August 2015. Passenger car prices have increased by $1,107 or 3.4% from August 2014, though they did dip $79, or 0.2 percent, from July of this year. Trucks and high-performance cars, on the other hand, showed significant price increases in August 2015.

In terms of pricing, “All major automakers are up year-over-year, but September will be a telling month depending on the impact of Labor Day sales and wavering financial market conditions ,” said Akshay Anand, analyst for Kelley Blue Book. “Hopefully manufacturers will stay disciplined and not over incentivize to meet sales goals if the markets continue to falter.”

Overall, the U.S. auto industry lost virtually no momentum in August, if anything, continuing to run at a seasonally adjusted annual rate, or SAAR, of 17.5 million vehicles, the fourth month in a row to top the 17 million mark. That’s a pace the industry hasn’t seen since 2006.

(Paul A. Eisenstein contributed to this report.)

“Those downsized, turbocharged engines powered 63% of the full-sized trucks Ford sold last month”

Not quite…they said Ecoboost powered 63% of F150 sales, not all full sized trucks

It should be interesting to see how these new turbo engines hold up long term under HD use. The prior 2.3L Ford, 2.2L/2.5L Mopar turbos and similar engines had high oil consumption problems at around 50K miles and onward in pass cars. With virtually all DI gas engines also having unusual carbon build-up in the intake ports and some in the combustion chambers, there are some real world challenges to address.