Despite concerns about potential conflicts of interest, Tesla Motors said Monday morning that it would complete its takeover of the solar power company SolarCity, a move it believes will lead to numerous synergies in its broader green energy strategy.

Tesla CEO Elon Musk said the all-stock, $2.6 billion deal will almost immediately result in $150 million in cost-savings, describing the deal as a “no-brainer” that “we should have done sooner.” But reaction has been skeptical since the proposed takeover was announced more than a month ago.

Together, Tesla and SolarCity “expect to save customers money by lowering hardware costs, reducing installation costs, improving our manufacturing efficiency and reducing our customer acquisition costs,” Tesla said in a statement.

Though its primary business is the production and sale of electric vehicles, Tesla has been pushing into other areas of sustainable energy, including its Powerwall, a home and office battery backup system. Last week, CEO Musk led a tour of the still-in-construction Gigafactory, in Reno, Nevada, that is just beginning to produce lithium-ion batteries for both its cars and those backup devices.

Tesla CEO Elon Musk has been serving as chairman of SolarCity, raising conflict of interest concerns.

(What’s inside the Gigafactory? Click Here for the story.)

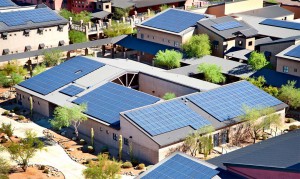

Founded in July 2006, SolarCity has become one of the country’s largest installers of rooftop solar systems. Combining the two firms, according to Tesla, will create “the world’s only vertically integrated sustainable energy company.”

The initial announcement of the SolarCity acquisition drew quick and unusually harsh criticism, at least in part because of perceived conflicts of interest. The solar array company is run by the Tesla CEO’s cousin, Lyndon Reve, and Musk himself has been serving as SolarCity chairman.

But the South African entrepreneur insisted that critics are missing the point. “The conflicts of interest are if we don’t merge.”

“As separate companies, it’s very difficult for us to work together,” said Musk, during a conference call with analysts. “It’s a very awkward process,” that will be simplified by working as one company. “It’s very limited what we can do until we’re one company.”

Among other things, officials from Tesla and SolarCity noted that the merged company will be able to make better use of the power electronics first developed for automotive applications, such as the Model S sedan. Together, the combined company could provide roof-top solar systems, battery backup devices and electric automobiles that could access both of those sources of power.

“With solar, you need to combine storage,” said Musk, noting that, “You need to buffer that power because people want energy 24 hours a day.”

Faced with sharp criticism – and the fact that some analysts downgraded Tesla shares after the SolarCity deal was announced, the company agreed to let the final decision be made by independent board members from each of the companies. Musk did not cast a vote. Going forward, shareholders at each company must also give their approval, though that is considered likely.

The announcement that the SolarCity deal will go through comes two days before Tesla’s second-quarter earnings were to be released. Analysts will be watching closely to get a measure of the company’s performance after previously learning that sales and production numbers fell below the California battery-carmaker’s initial forecast.

Tesla has, in fact, faced a number of recent challenges. The company is facing separate investigations by both the National Highway Traffic Safety Administration and the National Transportation Safety Board looking into a May 9th crash in Florida of a Model S sedan running in semi-autonomous Autopilot mode that killed 40-year-old Joshua Brown.

Tesla has been asked by several consumer groups to disable Autopilot but says it will instead move to improve the high-tech system.

(Model S was speeding at time of fatal crash. Click Here for the latest developments.)

The company is also facing a probe by the Securities and Exchange Commission for waiting almost two months after the May crash to reveal the news to the public. During that period, Tesla raised nearly $2 billion from a new stock offering meant to help fund final development of the Model 3, its first mainstream battery-electric vehicle. Tesla claims to have received about 400,000 advance reservations for that sedan—which it hopes to have in production by late next year.

(Mercedes pulls controversial self-driving ad. Click Here for the latest.)