Tesla CEO Elon Musk told shareholders their "faith will be rewarded" for approving the SolarCity acquisition.

In Elon we trust.

At least that’s what Tesla shareholders appear to be saying after approving the $2.6 billion acquisition of Musk’s SolarCity Corp. by a more than three-to-one vote.

“I think your faith will be rewarded,” Musk told shareholders.

Tesla’s founder and CEO pushed the deal, saying the combined companies would be much stronger and benefit from each other — to the tune of an additional $1 billion in revenue. He believes there will be plenty of synergies, but critics claim he has a conflict of interest being the head of both companies and they don’t share his vision for the pairing.

Musk owns 22% of both companies.

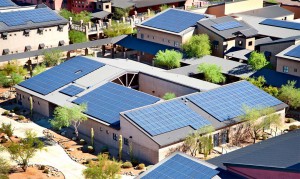

SolarCity is the largest solar panel installer in the U.S., and is readying to start selling the company’s first new product: Solar roof tiles. The tiles look like regular roofing shingles, but in reality glass solar panels. Musk expects to be a full production by early next summer.

(Tesla shareholder files suit to block $2.6 billion acquisition of SolarCity. Click Here for details.)

The CEO’s vision is that the combined companies will be a one-stop shop for tech savvy consumers with cash to spend. Buy a Model S and the solar roof tiles to charge it and even throw in a Powerwall battery to store some of the energy generated from the tiles.

Musk and two other Tesla directors who sit on SolarCity’s board recused themselves from the vote, but that didn’t stop some shareholders from suing, the Associated Press reported, adding the shareholders claim the merger is an attempt to use one company to bail out another.

Of course, Musk denies the claim, but there is some evidence to suggest the allegation may have merit. Neither company has ever managed a period of sustained profitability. Additionally, there’s not a mandate or huge demand for either product.

Plug-in electric vehicles make up less than 1% of U.S. sales, and less than 1% of U.S. electricity generation comes from solar power, AP notes, citing government data.

(Click Here for details about Tesla’s plan to raise more cash.)

That said, Tesla did report a net profit of $22 million in the third quarter, its first quarterly profit in three years. SolarCity reported a third-quarter loss of $225.3 million.

And while some skeptical shareholders suggest the deal is a sham, there are some believers — at least on some level.

Efraim Levy, an equity analyst at CFRA Research, was is anti-deal because he views it as a distraction from the car company as well as a drain on its cash. He has a “hold” rating on Tesla’s stock.

“Elon Musk is clearly a force for change, but we think TSLA shareholders will see rewards delayed,” Levy wrote in a note to clients.

(To see more about Tesla unexpected third quarter profit, Click Here.)

However, he does suggest there are a few benefits. Tesla and SolarCity have said they could save $150 million in the first full year thanks to reduced marketing costs and other synergies, he noted, adding the deal could also reduce the cost of financing for SolarCity.