President Donald Trump gave himself an A for how he handled policy decisions earlier, but what grade is the auto industry giving him?

With the three domestic automakers each reporting first-quarter earnings this week, President Donald Trump’s tax cut proposal – which would see the top corporate rate drop by more than half, to 15% – clearly resonates in the Motor City.

General Motors said in a statement that it was “encouraged” by efforts to “modernize our tax code,” while crosstown rival Ford saw the White House announcement as “a positive step towards much needed tax reform.”

It’s not the first time industry leaders have hailed a Trump Administration move, automakers giving thumbs up when the president ordered the EPA to reopen the midterm review of federal mileage standards. But the president has also been harshly faulted on a number of issues, notably a proposed import tax and the threatened elimination of the North American Free Trade Agreement.

And now, as the businessman-turned-politician approaches his 100th day in office, several industry leaders and analysts when asked for to provide a letter grade for the new president are giving Trump’s overall performance a “C”, at best – with some saying he deserves an “Incomplete.”

There have been few surprises, candidate Trump signaling his stand on a number of key issues impacting the auto industry – notably jobs, trade and government regulations – early on. Ford learned that the hard way when it was the target of a Twitter-storm after announcing plans to move small car production to Mexico. Trump later took on General Motors and Toyota, among others, demanding they shift production to the U.S. or face border taxes he threatened could run as high as 35%.

(Trump backs off assault on NAFTA. For details on the change, Click Here.)

“I don’t think (Trump) understands the incredible spider web of the intricate auto industry supply chain,” said Joe Phillippi, head of AutoTrends Consulting, noting that it’s not unusual for automotive parts and components to repeatedly cross the border before a finished car rolls off the line.

Pressure from the CEOs of Ford, General Motors and Fiat Chrysler may have helped derail President Trump's border tax.

The auto industry has aggressively resisted the elimination of NAFTA and the imposition of a border tax, the American Automotive Policy Council, a trade group representing Detroit’s Big Three, this week declaring, “The integrated North American market is important to our global competitiveness.” Foreign-owned makers have been at least equally vocal. So have automotive dealers. And with a strong presence in virtually every state and Congressional district, retailers – who are fond of supporting receptive politicians – have made sure their opposition has been heard.

Apparently it worked, as Trump indicated late Wednesday his goal now is to revise, rather than eliminate, NAFTA. Meanwhile, leaders on Capitol Hill have been clear in their own opposition to any import tariffs which could raise consumer prices – and threaten support for the GOP during the 2018 mid-term elections.

While automakers mobilized to preserve NAFTA, they’ve been far more upbeat about other Trump proposals, notably including his order directing the Environmental Protection Agency to reopen the mid-term review of the Corporate Average Fuel Economy standards set to climb to 54.5 mpg by 2025. In its final weeks, the Obama Administration had declared the review complete, the mileage target to stand.

While environmentalists have labeled that a critical step in meeting America’s commitment to reduce Global Warming gasses, the president, a climate change skeptic, has already taken a number of steps to weaken Obama-era environmental rules.

And he appeared to accept the claim made by Ford CEO Mark Fields, during a meeting at the White House, that CAFE, as it stands, could cost up to 1 million American jobs. That said, while the review is set to resume, it remains unclear if the mileage rules will be rolled back, or perhaps the target date delayed. And even if that happens, industry leaders have signaled it may be too little, too late.

“With the typical industry product cycle, which is five to six years, what we’re going to launch (in 2024 to 2025) is already in the pipeline,” said Ford’s President of the Americas Joe Hinrichs, adding that the most a rollback likely would now do is let automakers shift their model mix. In other words, if consumers are still demanding big trucks mid-decade, automakers would sell more of them and fewer hybrids and EVs.

Nissan boss Carlos Ghosn, meanwhile, said “we will not change any of our plans” for clean, efficient vehicles, if for no other reason than the fact that other key markets, including Europe and China, aren’t cutting back on their mileage and emissions rules.

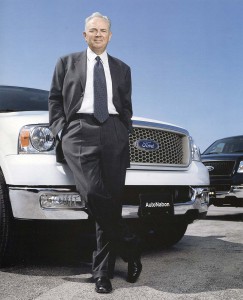

One thing automakers uniformly look forward to is having the new president cut back on what Mike Jackson, the CEO of AutoNation, calls “onerous regulations.”

“I give (Trump) high marks for stopping the onerous, overbearing regulations of the last eight years and putting in place skilled regulators who will take a more prudent approach,” said Jackson, whose company is the nation’s largest auto retail chain.

In other areas, however, Jackson doesn’t rate Trump’s performance during the first 100 days nearly so well. He points to a near-complete lack of legislative accomplishments, beyond winning confirmation for Supreme Court nominee Neil Gorsuch. And as for “temperament? The tweeting has to stop. It’s not just presidential and it holds back his agenda. Everyone is aching for substantive results,” he said.

That includes the president himself, Trump using those tweets to take credit for a number of supposed victories in recent months. That includes the decision by Ford to scrub plans for a second Mexican plant, as well as billions in new North American investments by General Motors, Fiat Chrysler and Toyota. The problem, senior industry officials have publicly said on a number of occasions: the president is wrong.

(Click Here for more about Trump’s border tax talk.)

Ford’s decision to scrub the Mexican plant was “already in the pipeline” well before the election, said Hinrichs, adding that the maker is still moving small car production south of the order. The GM, FCA and Toyota plans, with only a few minor exceptions, were also in process as long as two to three years ago.

Perhaps no single issue has underpinned the Trump campaign and, now, the Trump Administration, like jobs. That helped the candidate connect with blue-collar and middle-class voters like no other topic. The question is how much will the auto industry be able to deliver.

Without the threat of new tariffs and an end to NAFTA, there’s less pressure on automakers to bring back manufacturing operations. And “anything we (do) bring back will be super-automated,” stressed Marina Whitman, a one-time GM executive vice president who now serves as a professor of Business Administration and Public Policy at the University of Michigan.

For his part, Matt Simoncini, Lear’s top executive, told TheDetroitBureau.com he has been looking for several years at opportunity to return some of the auto seating supplier’s manufacturing jobs to the U.S.

“The reality is that some things will never be able to be produced, from a labor standpoint, in the U.S. on non-poverty wages,” the Lear CEO says. “So, certain components we will not be able to make (here) and get shareholders the return on investment they expect. But other things, when you balance the freight costs, the geo-stability risks, the benefits of being able to send engineers right to the factory without taking a plane trip, there are certain things we think we can do right here.”

But, echoing Whitman, Simoncini expects to resort to high levels of automation. On the whole, analysts say, parts plants that might have employed 1,000 in decades past might create 50 to 100 jobs if and when they return to the U.S.

Going into the White House, the new president laid out an aggressive agenda that included broad health care reform, rewriting the U.S. tax code, a major, job-creating infrastructure program, rollback of federal regulations, new immigration restrictions and the defeat of Islamic terrorists. He has so far issued a number of Executive Orders – several key ones blocked by the courts – and gotten his nominee a seat on the Supreme Court.

“He’s known for his braggadocio, but once he got into the seat he has come to learn there are all sorts of political realities” that make it difficult to put campaign promises and policies into action, said analyst Phillippi.

(NADA Chief implores Trump to undo Obama auto rules. Click Here for the story.)

In terms of what Trump has so far done for the auto industry, “If I had to give him a grade, I would give him a C for at least getting the ideas on the table” though based on turning those ideas into policy, after 100 days, said the veteran industry observer, “It would have to be an incomplete.”

The tax cut is encouraging but I’m glad to see the auto industry is being vocal about NAFTA and the impacts of a border tax on the industry.

The quote “I don’t think (Trump) understands the incredible spider web of the intricate auto industry supply chain,” said Joe Phillippi hit the nail on the head.