The era of the crossover, or ute, is nearly over, according to one analyst; however, not everyone believes that prediction.

The end of the crossover boom could be approaching its peak even as car makers continue to push new models into showrooms, says a top automotive analyst.

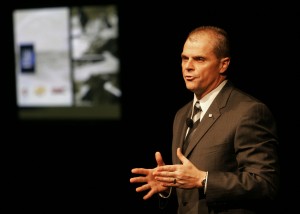

As he presented the annual “Car Wars” study, John Murphy of Bank of America Merrill Lynch told the Automotive Press Association that the CUV market share now stands at 35%, but even as new, luxury models enter the segment 40% could be the limit.

In the past, the “Car Wars” studies pointed to the fact that Asian car makers were generally replacing vehicles in their showrooms with new models at a faster rate than their North American and European models.

However, the competitive landscape has shifted and General Motors and Fiat Chrysler Automobiles N.V. are now in a position to bring in new models at a faster rate because of the traditional strength in crossovers and trucks, according to Murphy, the principal author of the study.

In fact, at least one automaker responsible for this influx of utility vehicles/crossovers, is betting big on their continued popularity, seeing a market that is better than Murphy’s predicted 40%.

(To see how crossovers/utes could account for half the U.S. new vehicle market, Click Here.)

Ford's Mark LaNeve said today that he expects SUV sales to remain strong and Ford plans to add four new iterations to capitalize on the trend.

Utes have become the hottest segment in the industry, in part because carmakers continue to find ways to surprise and delight customers with all manner of new designs and features, said Mark LaNeve, Ford’s head of sales, service and marketing. And where classic SUVs once required owners to “sacrifice” things like fuel economy and on-road comfort, today’s utes are nearly as efficient and comfortable as conventional sedans and coupes.

As a result, “We don’t see (the SUV sales boom) stopping,” said LaNeve, as Ford revealed two new versions of its popular Explorer SUV and announced plans to update the long-neglected Expedition model for the 2018 model-year.

As recently as 2006, utility vehicles – which include classic SUVs, as well as newer crossover-utility models – accounted for just 28% of the American new vehicle market. That hit 40% in 2016, and the upward trend continued during the first quarter of 2017, LaNeve noted.

“Over the next five to seven years, we see it getting to 45%, even higher,” he said at the Manhattan even. “It could reach 50%.”

The product launch cycle gives GM, which is preparing to launch a new version of the Chevrolet Silverado even as it replaces its midsized crossover vehicles such as the Chevrolet Equinox, and FCA, which is bringing out new versions of the Jeep Wrangler and Dodge Ram pickup, an edge as the competition heats. Both companies, but particularly GM, could pick up market share.

Toyota also is in a strong position, but Ford Motor Co., Nissan and Honda will have little new product to talk about for the 2018 and 2019 model years, though the number of product launches increases for Honda and Ford during the 2020 and 2021 model years at the back end of the study, which covers four model years, he said.

Ford, however, has the potential to do well in the 2018 model year with the introduction of the new Ford Expedition and Lincoln Navigator, which have been eased out into public view for the first time during the winter and spring. If Ford can succeed in doubling the sales of Expedition and Navigator from about 50,000 units to 100,000, it could add as much as a billion dollars to the company’s bottom line.

(Automakers push out new wave of high-performance SUVs. Click Here for the story.)

Nissan’s product cadence is less focused, Murphy said. “Nissan is all over the map,” he said.

The European carmakers, Volkswagen AG, BMW and Mercedes-Benz, also are bringing on new luxury crossover that will increase competition in the segments. “European (manufacturers) in total are at the lower end of the range for replacement rate although VW is close to the average, while German luxury (brands) are below (average.)

Murphy noted that sales of crossover vehicles have grown steadily since the recession and number of crossover nameplates is expected to grow 110 from 78 in the next couple of years as the competition continues to intensify.

“Product activity is picking up across the board, which is consistent with the late stage of a cyclical recovery,” the report noted. “However, an abundance of new production in a declining market may result in overcrowding.”

Murphy added in his presentation to the Automotive Press Association in Detroit that the overcrowding has already slowed the growth of average transaction prices and started to put pressure on manufacturers t reduce prices on some models.

The industry is also facing a “tsunami” of off-lease cars, which will put pressure on sales of new vehicles and drive down residual prices, which are critical to financial underpinning of vehicles leases.

Murphy said he still predicting sales could reach 18 million units next year but no longer thinks sales will reach the 20 million level he predicted two years ago. Indeed new vehicle sales have faltered so far this year and, following 2018 could trend downwards towards through of 13 or 14 million units early in the next decade.

(Click Here to see more about sliding new vehicle sales last month.)

Car makers, though, are continuing to invest heavily in new models as the end of the cycle approaches, which is putting pressure on the industry. One possible consequence of a slowdown in sales would be a slowdown in investment in electric and autonomous vehicles. Such a slowdown would push back the coming of autonomous vehicles until the middle of the next decade.