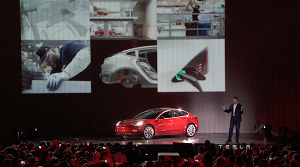

Elon Musk, Tesla founder and CEO, talks through a design issue on Model 3 during the new vehicle's debut.

In front of a crowd of thousands of cheering Tesla employees, Elon Musk may have taken the shortest victory lap ever, driving a new Model 3 onto a stage, a route of probably less than 500 feet to kick off the delivery of the first 30 Model 3s to customers.

Though the hype leading up to the moment was tough to escape, it was a milestone moment in the company’s history — a moment many thought to be a pipe dream about a decade ago when Musk was running around with the Roadster telling folks a mainstream EV was the company’s goal and that it would happen.

“The whole point of Tesla was to build a great affordable electric car,” Musk said last night. “That’s what this day means. I’m confident it’ll be the best car in its class, gasoline or not, hands down.”

The car, which is still in the ramp-up stage of production, comes in a Musk’s long-ago predicted price of $35,000. For that, you get 220 miles on single charge with a 0-to-60 time of 5.6 seconds and a top speed of 130 mph and room for five adults. For an additional $9,000, you can get more performance: 310 miles on a charge. The 0-to-60 drops to 5.1 seconds and the top speed jumps to 140 mph.

(Tesla cutting from the bottom: kills Model S 75. To find out why, Click Here.)

Musk delivered the first 30 Model 3s to customers in front of thousand of cheering employees at the company's plant in Fremont, California.

While the company hopes to be up to full production sometime next year, if you try to plunk down your $1,000 deposit to order a Model 3 now, you won’t get yours until late next year, which also means you are unlikely to be able to take advantage of the tax credit for EVs, which drops the price of the Model 3 below $30K, just like its competitors the Chevy Bolt and Nissan Leaf.

“The uncertainty of tax rebates is still a big concern for Tesla reservation holders,” said Jessica Caldwell, Edmunds executive director of industry analysis, pointing out that Tesla has less than 79,000 credits remaining.

“Tesla appears to be prioritizing employees, investors and current Tesla owners for delivery of the Model 3, all while the company continues to sell the Model S and Model X, which will eat into Tesla’s dwindling tax credits. It’s still a big question whether the thousands of people in line to buy a Model 3 will be able to stomach the full price of the car without a hefty rebate.”

Strong sales of the long-awaited Model 3 are the key to the company finally turning a profit, which it has never done. A big part of the appeal of the new EV is the sub-$30K price tag and if Tesla’s prioritized delivery schedule is likely to leave virgin owners out of the tax credit bonus, there are concerns they may not hang around. This has some analysts concerned.

New Tesla Model 3 owners got to pickup their new vehicles straight from the factory completely charged.

“The make-or-break part of this for Tesla isn’t the production numbers, it’s the profitability and ownership experience issues,” Karl Brauer, executive publisher at Autotrader and Kelley Blue Book, told USA Today.

(Click Here for more on Tesla’s efforts to set up a Chinese auto plant.)

“If one or both are off, it’s big trouble. It’s tough to be a company that specializes in EVs, as they’re only 1% of market and most electric cars aren’t profitable for their companies.”

Another concern is production levels. Musk told the audience there were 500,000 reservations for the new Model 3. Tesla, which is still producing the Model S and Model X, officials continue to claim that they expect to build 500,000 units annually by 2019, which would be another lynchpin in the plan to profitability.

The Model S and Model X were plagued with problems during the early portion of their production runs and they were built at a much slower pace. However, Musk points out that the Model 3 is a much less complicated vehicle to build with much fewer parts, which should help offset many of the headaches the aforementioned vehicles experienced.

“There’s nothing in the car that doesn’t need to be there,” he said.

Investors have been showing their faith in Musk and the company as Tesla’s share price has risen 54% since January despite the fact that the company has blown through $2 billion to launch the Model 3. Tesla’s valuation now exceeds that of General Motors Co and Ford Motor Co.

(For more about the Tesla Model 3, Click Here.)

He’s going to need both their faith and some profits because Musk has more products in the pipeline, including a semi-truck, a pickup truck and other vehicles to add to the line-up and all of those different vehicles have one common need: cash.