Tesla CEO Elon Musk said the company is diverting resources from its semi truck launch to Model 3 production, which is behind schedule.

Tesla’s troubles continue to mount, even as investors appear to be holding onto a long view of the company, largely ignoring delays that include the slow ramp-up of production of the critical Model 3 sedan.

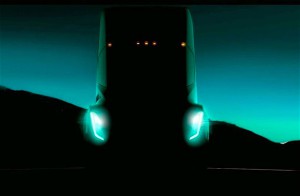

The California-based battery carmaker is again delaying the much-anticipated unveiling of its first-ever electric semi-truck. The event originally was scheduled for September then pushed back to Oct. 26. It now will take place Nov. 16, said CEO Elon Musk.

The latest delay comes because Tesla is “diverting resources,” Musk said in a tweet, to resolve problems that have resulted in extremely slow production of the Model 3. The company is still largely having to hand-assemble the electric sedan, according to several reports, pushing it far behind on the ramp-up of a vehicle that is expected to finally bring Tesla into the black after years of substantial losses.

This month’s debut of the semi-truck was expected to come just ahead of Tesla’s third-quarter earnings report and, several analysts told TheDetroitBureau.com, appeared to be aimed at downplaying the likelihood the numbers for the July to September period will show a sharp, year-over-year decline.

(Investors hammer Tesla as Model 3 production hits “bottlenecks.” For the story, Click Here.)

Tesla sales actually hit a record during the third quarter as it delivered 26,150 vehicles. But that included just 260 of the new Model 3 sedans, well below the 1,500 the automaker had originally forecast due to what it described as “production bottlenecks.”

Complicating financial matters, Tesla has cut the price on many of its existing product variants, such as the Model S P100d, in order to maintain demand as many potential buyers look at their options with the new Model 3 — which costs less than half as much as the older electric four-door. According to various sources, some vehicles are now rolling off Tesla lots with discounts and incentives worth as much as $30,000.

During the second quarter of 2017, Tesla managed to trim losses, however, to $1.33 a share, a significant showing compared to the $1.82 Wall Street analysts had forecast. Revenues for the quarter came in at $2.79 billion, also ahead of the $2.51 billion consensus forecast.

A poor showing for the third quarter could complicate matters for Tesla, especially if it continues to face what Musk earlier this year could be “manufacturing hell” as it struggles to boost production at its Fremont, California, assembly plant.

“The company may well have far too much on its plate,” said Michelle Krebs, an industry analyst with Autotrader.com.

Along with building cars, Tesla is still digesting the takeover of SolarCity, while also ramping up production at its massive Gigafactory battery plant near Reno, Nevada. It is also pushing into the stationary battery back-up business, including a $100 million project in Australia. And Musk himself is heading the rocket company SpaceX, while trying to launch a tunneling business known as The Boring Co.

(Click Here for more on a series of recent setbacks for Tesla.)

The Model 3 actually got off to a seemingly good start, production beginning in July, seemingly on time. The maker’s previous new product line, the Model X SUV, was two years behind schedule.

Tesla is reportedly offering discounts as much as $30,000 on Model S inventory it is trying to clear out.

But it appears the latest launch was massaged to give the appearance of meeting Tesla’s timetable. Last week, trade publication Daily Kanban reported that Tesla’s Model 3 assembly line isn’t fully in place and, as a result, it has boosted production from four per day during the third quarter to anywhere from five to eight at the moment.

Other reports have suggested that suppliers are still not up to speed, either, and some parts going into the Model 3 are essentially hand-made. Tesla recently confirmed it is struggling to get more parts from those suppliers.

Without a significant breakthrough, that would find Tesla producing less than 1,000 of the new battery-sedans by the end of this year, a fraction of what its original forecast had been. And, at its current rate of growth, the competing Chevrolet Bolt EV could wind up with as much as 20 times the volume for the year, according to analyst Anton Wahlman.

The bigger question is how long will it take to bring Tesla’s production ways under control? Musk has promised that Tesla will produce 500,000 vehicles at the Fremont plant in 2018, about 80% of those being Model 3 sedan. With lower prices and margins, volume will be critical to making the carmaker’s goal of getting into the black. Tesla has broken even just twice since going public.

(Tesla getting ready to reveal first battery-electric semi truck. Click Here for more.)

Despite a recent string of troubling reports, investors continue to hang tight on Tesla shares, however. While the stock is down from its 52-week high of $389.61, it gained 0.44% on Friday to close at $356.88 a share.