A century of growth seems likely to come to a screeching halt for the global auto industry, and that spells potentially serious trouble for major automakers, according to a new study – though the report also anticipates big opportunities for ride-sharing services.

It is widely expected that the auto industry will go through more radical changes in the coming decade or so than it has since Henry Ford fired up his first moving assembly line. Among other things, the report by the Boston Consulting Group, or BCG, anticipates that electrified vehicles will soon become commonplace, while millions of motorists in the U.S. and abroad will switch from owning a car to relying on ride-sharing services like Lyft and Uber.

So, while global auto sales will continue to grow to around 108 million annually, “We will (then) reach a plateau around 2029 or 2030,” forecast Thomas Dauner, the head of the auto practice at BCG. “An industry that has been growing over the past century will stop.”

That alone might spell big trouble for traditional automakers – OEMs in industry parlance. But that’s only the beginning of the challenges that could threaten their very survival, the new report warns.

(A substation on every corner? Mass EV charging presents unique challenges. Click Here for the story.)

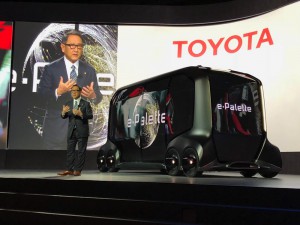

Toyota CEO Akio Toyoda introduces the e-Palette, a driverless shuttle set to go into pilot use during the 2020 Tokyo Olympics.

The study looked at the various changes that are widely forecast to change the way people travel by car, notably the coming of electrified vehicles, the debut of autonomous and fully driverless cars, and the emergence of ride-sharing as a significant alternative to private vehicle ownership.

Today, only about 3% of the new vehicles sold worldwide use some form of battery propulsion, from hybrids to fully electrified powertrains, but BCG anticipates that will reach 67% by 2035. The “tipping point,” said Dauner, will come early in the 2020s as the price of batteries drops to the point when those vehicles will be competitive with models using conventional, internal combustion engines.

That overlaps with the debut of self-driving vehicles that are expected to account for around one in four of the vehicles on the road by 2035. Robocabs alone will make up about 9% of vehicle sales by then, forecast BCG.

Fully driverless vehicles operated by ride-sharing services are expected to become commonplace in the world’s cities by then. And because they will slash operating costs they’ll become cheaper to use than owning and operating a vehicle for many consumers, said Dauner.

So, in many cases, motorists will cut back on the number of vehicles in the household fleet – today averaging about 2.4 cars per household in the U.S. – or abandon ownership entirely. By 2035, “about 20%” of the miles that Americans travel by automobile will be in driverless ride-sharing vehicles, forecast the BCG study.

GM's new car-sharing service, Maven, is expanding its operations in New York City by adding 80 vehicles.

A lot of money is at play as a result of this transformation. Today, the car-based mobility industry generates revenues of around $3.7 trillion annually worldwide, a figure expected to grow to $5.8 trillion by 2035.

(Click Here for more about BCG’s prediction that 50% of vehicles will be electrified by 2030.)

But sales of conventional new vehicles will actually tumble over the coming two decades, the study noted, as will a number of other traditional lines of business such as aftermarket sales and service. That reflects the fact that electric vehicles will need less repairs and services like oil changes.

Sales of electrified vehicles will surge, but so will other new areas of business, especially for on-demand mobility. By 2035, “mobility on demand,” a fancy way of saying ride-sharing services, will generate an estimated $76 billion annually, or about 25% more income than the manufacturing of traditional vehicles.

Meanwhile, the companies that produce autonomous and electrified vehicle components – firms like NVIDIA, Delphi, Waymo and Continental – will be generating as much or more revenues than the carmakers that today dominate the business.

Unless they can rethink their business equation, OEMs such as General Motors, Volkswagen and Toyota could find themselves commoditized and struggling for every penny.

A few manufacturers have recognized the challenges they face, Dauner noted. GM, for one, is trying to build a new business model that takes into account autonomous and electrified vehicles. The Detroit giant has even set up its own sharing service, Maven. Volkswagen and Daimler AG, the parent of Mercedes-Benz, have also been looking for ways to maintain control as new technologies come to market and motorists by the millions shift to ride-sharing services.

“They are making some very serious strategic decisions,” said Dauner.

Automakers aren’t the only ones who have to rethink mobility in the years ahead, the new study emphasizes. Governments around the world will have to decide what role they play in determining transportation policy.

(To see more about GM’s strategies for ride-sharing and driverless tech, Click Here.)

“The question is whether they will be fast enough or bold enough” to adapt to the coming changes, said Dauner.

Nope. Too many variables at this point to predict anything