Tesla shares took another 5% tumble on Monday after reports surfaced that the automaker once again missed its production targets for the much-delayed Model 3 battery-sedan.

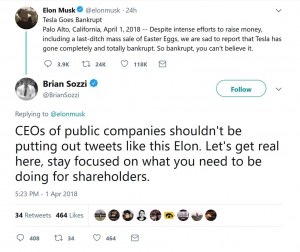

Delays in the roll-out have hammered Tesla’s balance sheet, with some analysts expecting the California carmaker to have to go back for another fundraising round. It didn’t help to have Elon Musk post an April Fool’s Day joke indicating the automaker would be declaring bankruptcy.

In an e-mal sent to Tesla workers on Monday, Musk said production of the Model 3 had reached the 2,000 per week mark at the end of the first quarter, but that is still short of the 2,500 target Tesla had projected back around the beginning of the year, and it is even more substantially behind the original target Tesla had laid out when Model 3 production began in July 2017.

A Tesla representative stressed that the numbers being reported today are not official. They come from a report published by website Jalopnik which cited a letter it claim to have obtained that was sent by Musk to company employees. Official numbers are expected this week, and very possibly on Tuesday.

Nonetheless, the report had a harsh impact. At the closing bell on Monday, Tesla stock stood at $252.48, a $13.65, or 5.13% drop from Friday’s wrap-up. And it is off about 35% from the automaker’s 52-week high of $389.61.

(Tesla shareholders approve multi-billion dollar package for Musk. Click Here for details.)

Tesla has been facing a wide range of setbacks in recent weeks, something that Musk apparently hoped to lighten with his weekend tweet that was meant to look like a corporate news release. “Tesla Goes Bankrupt,” declared the mock headline, continuing, “Palo Alto, California, April 1, 2018 — Despite intense efforts to raise money, including a last-ditch mass sale of Easter Eggs, we are sad to report that Tesla has gone completely and totally bankrupt. So bankrupt, you can’t believe it.”

While there are some analysts who question the carmaker’s long-term viability, most others are placing their bets on a turnaround in Tesla stock, especially if and when it finally works out the bugs at its Fremont, California factory and gets Model 3 production up to speed.

A long-term skeptic who, until recently, had advised investors to sell their TSLA shares, CFRA analyst Efraim Levy on Monday issued a “Hold” recommendation, forecasting “an eventual resolution of production issues could provide an upward catalyst for the shares.”

The question for other observers is how soon that will happen. Tesla had an estimated 400,000 advance reservations for the Model 3 by the time production began, and Musk had anticipated building about 500,000 vehicles in Fremont this year, 80% of them the new, mainstream-priced electric sedan.

The question for other observers is how soon that will happen. Tesla had an estimated 400,000 advance reservations for the Model 3 by the time production began, and Musk had anticipated building about 500,000 vehicles in Fremont this year, 80% of them the new, mainstream-priced electric sedan.

Many customers are now expected to have to wait until 2019 or beyond to take delivery. And there are widespread concerns that some buyers will ask for their $1,000 deposits back and go buy one of the growing number of competing products. The Chevrolet Bolt EV is already outselling the Model 3. Nissan has launched a new, longer-range version of its Leaf battery-electric vehicle. And even more products are on the way, including the Hyundai Kona that debuted at the New York Auto Show last week. That Korean model will get an average 250 miles per charge, or 30 more than the Model 3.

Tesla’s problems have been mounting at a dangerous pace. It last week announced its largest recall ever, corrosion with Model 3 steering bolts involving more than half of all the vehicles the company has ever produced.

Last Friday, the company also disclosed that a Model X SUV involved in a fatal crash in California was being driver in semi-autonomous mode – though Tesla also said that the vehicle had warned the driver to regain manual control before it struck a concrete median.

(For more on the fatal Tesla crash, Click Here.)

Another incident in January was also potentially linked to the Autopilot system, though there were no serious injuries in that crash.

Those and other issues pale in comparison to the challenges of getting Model 3 going, however. Tesla is still operating at about 20% of its target for the Fremont plant and that is all but certain to keep its balance sheet in the red for some time. With the company having blown through about $3.5 billion in cash last year, according to a Wall Street Journal report, it is becoming more likely Tesla will need to raise more equity sometime in the coming year.

(Tesla stock in freefall. Click Here for more on that story.)